Businesses decide to close permanently for a wide range of reasons. From owner retirement to limited cash flow or disagreements between members, the list goes on.

Simply locking the doors and taking the sign down isn’t enough. You need to take specific steps to dissolve your LLC officially.

Depending on the circumstances of your dissolution, you might not be thrilled about having to file extra paperwork and wrap things up appropriately. But taking the time to dissolve an LLC the right way will help limit your liability down the road and ultimately make it easier to move forward with future ventures.

Think back to when you formed your LLC. Remember all of the paperwork you had to file with the state, IRS, and local agencies? Unless those authorities are told otherwise, they’ll assume you’re still an active business, required to file annual reports, pay taxes, and pay yearly fees.

These requirements end when you officially dissolve your LLC.

Regardless of your situation, this can be challenging for business owners, especially those who have never been through this process before. Follow this guide for detailed instructions on how to formally dissolve your LLC.

Types of LLC Dissolution

LLC dissolutions typically fall into one of three categories—voluntary, administrative, and judicial.

- Voluntary LLC Dissolution — Voluntary dissolution occurs when the LLC members willingly decide to close the business. It can happen as the result of a dissolution trigger previously described in the LLC operating agreement, such as the death of a member. Members can also vote to dissolve the business at any time.

- Administrative LLC Dissolution — This occurs when the business fails to comply with state requirements. An administrative dissolution comes from the Secretary of State’s office. While laws vary from state to state, LLCs can typically be dissolved at any time for reasons that the Secretary of State deems appropriate.

- Judicial LLC Dissolution — As the name implies, this is a court-ordered dissolution. Courts have the power to dissolve LLCs if the business does not comply with state laws. It can also occur when companies fail to pay their taxes. Sometimes a disgruntled LLC member who wishes to cut ties with the business will file a lawsuit against the company, resulting in a judicial dissolution.

Whatever category your dissolution falls in, you still need to follow the steps outlined in this guide for formal dissolution.

How to Dissolve an LLC in 6 Easy Steps

The exact forms you’ll need to file will vary from state to state. But the process explained below is considered to be universal and applies to LLCs nationwide.

Step #1 — Officially Document the Voting Record

Assuming you fall into the voluntary dissolution category (and a dissolution trigger has not occurred), members need to vote on this decision.

The voting procedure should be clearly outlined in your LLCs operating agreement. If this process was not previously specified, follow the voting procedure described in the LLC statutes for your particular state.

This is pretty straight-forward for single-member LLCs. But LLCs with multiple owners need to take this step seriously to ensure the vote is formally documented. Otherwise, members could potentially stir up trouble down the road, saying they never agreed to dissolve the company—and it could get messy.

Keep a written record of this decision. An LLC resolution document should be sufficient in most cases. Here’s an example template and form from Northwest Registered Agent you can download for free.

There are dozens of similar forms you can find online. Alternatively, you can use an official document suggested and provided by your attorney.

Keep this document in a safe place alongside the official records of your LLC.

Step #2 — Settle Creditor Claims

In many states, you can’t officially file dissolution paperwork until you’ve notified your creditors and settled any outstanding claims. Send them an official notice and explain how they should submit claims. Include a deadline in this notice as well.

The exact deadline for creditor claim submission will vary from state to state. But most state LLC statutes give creditors between 90 and 180 days from the date of notice to submit a claim. Include a section in the notice specifying that claims submitted after the deadline will be disregarded.

Examples of creditors you need to notify include:

- Lenders

- Suppliers

- Insurance carriers

- Service providers

- Secured creditors

- Unsecured creditors

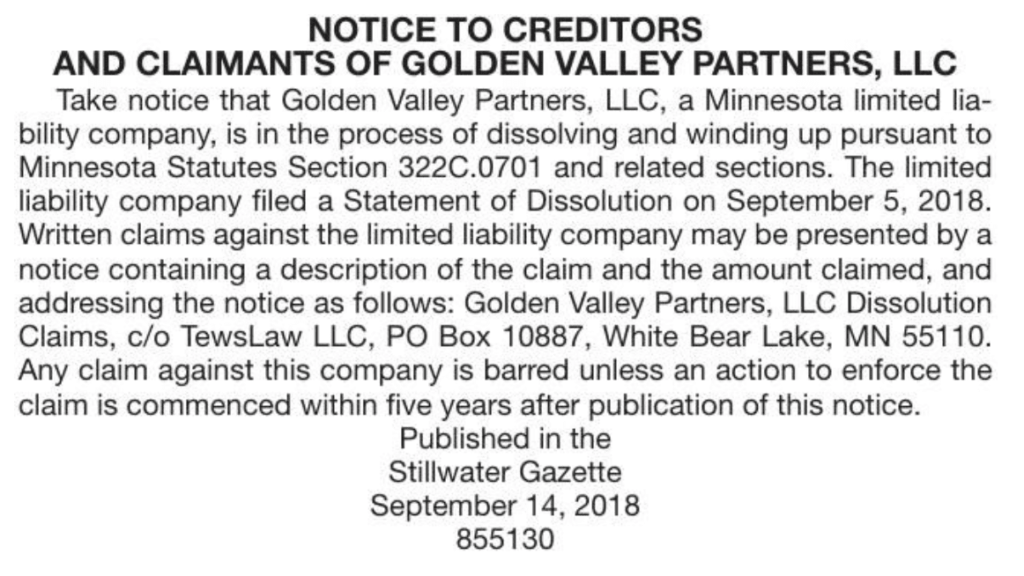

Some states also require you to publish notice of the dissolution in a local paper. Here’s an example of what that looks like:

Even if your state doesn’t technically require you to notify creditors, it’s still good business practice to do so. Settling your debts and financial obligations help limit your liability, prevent late fees, prevent litigation for unpaid claims.

Step #3 — Pay Final Wages and Take Care of Employees

If your LLC has employees, you need to pay them all final wages and any compensation owed. You’ll also have to pay all employment taxes associated with the payroll run as well.

Employees must be provided W-2s and tax statements for the year in which final wages were received. Don’t forget to pay any contractors and report those payments to the IRS.

Some people will need to take extra steps to terminate employee retirement plans, health benefits, and other employee programs. You can handle this directly with the providers.

Your accountant can help you with the proper documents for notifying the IRS, which brings us to our next step.

Step #4 — Notify Tax Agencies and Licensing Authorities

Your tax obligations won’t magically cease when you decide to end your business operations. All taxes must be paid to local, state, and federal taxing agencies.

You’ll also need to file a final tax return for your LLC.

The IRS has a “closing a business” page on their website that includes more information on the forms you need to file. Your accountant should be able to provide some assistance here as well.

Part of this process includes closing your IRS business account and “canceling” your EIN. Technically, your EIN is not actually being canceled. The IRS will never re-assign it to another entity. But you still need to close your account with the IRS, so they know that the EIN is no longer being used. Send them an official letter with the following information:

- The full legal name of the LLC

- EIN

- Address of LLC

- Reason for closing the account

- A copy of the letter with your assigned EIN (if you have it)

Mail this documentation to:

Internal Revenue Service

Cincinnati, OH 45999

If you have a DBA or fictitious name associated with your LLC, make sure you cancel or withdraw that name in the state in which it was issued.

Depending on your business type, you may have obtained specific licenses and permits to operate. You must notify the agencies that issued those licenses and permits to cancel them. Make sure you settle any outstanding fees associated with your licenses as well. If you’re starting another venture, you might have the option to transfer your permits to the new entity.

Step #5 — File the Articles of Dissolution

Once the LLC members have formalized the decision to dissolve the company, you need to file paperwork in the state where your business was formed. If your company is registered in multiple states, paperwork must be filed in each of those states.

Depending on your state, Articles of Dissolution may be referred to as a Certificate of Dissolution, but it’s the same thing.

The exact process for filing the paperwork will vary from state to state. For example, some states require you to file this documentation prior to resolving outstanding claims and notifying creditors of the dissolution. Other states require you to notify creditors and resolve claims before they will accept your Articles of Dissolution.

Certain states also require you to catch up on any back taxes before filing the dissolution paperwork.

Check with your registered agent, Secretary of State office, or online formation service if you’re unsure of your particular state’s proper order.

Once the Secretary of State has approved the paperwork, your LLC has technically been dissolved.

Step #6 — Distribute Remaining Assets

The final step to dissolving your LLC is splitting assets between members. For single-member LLCs, this is easy. As the sole owner, everything is yours.

Multi-member LLCs will need to spend a bit more time here. Generally speaking, assets are split based on the ownership percentage of the members. For example, let’s say you have three owners with a 40-40-20 ownership share; assets would be distributed based on the same percentages.

With that said, some LLCs have different disbursement rules. These should have been outlined in your LLC operating agreement when your LLC was first formed.

Examples of assets include profits, financial investments, property, and physical goods. You might want to liquidate the assets before splitting them up. For example, let’s say your LLC has trucks, inventory, and machinery. In many cases, it’s easier to sell these and split the cash instead of giving each member a commercial vehicle.

Make sure you follow state’s laws when distributing assets. All distributions must be reported to the IRS.

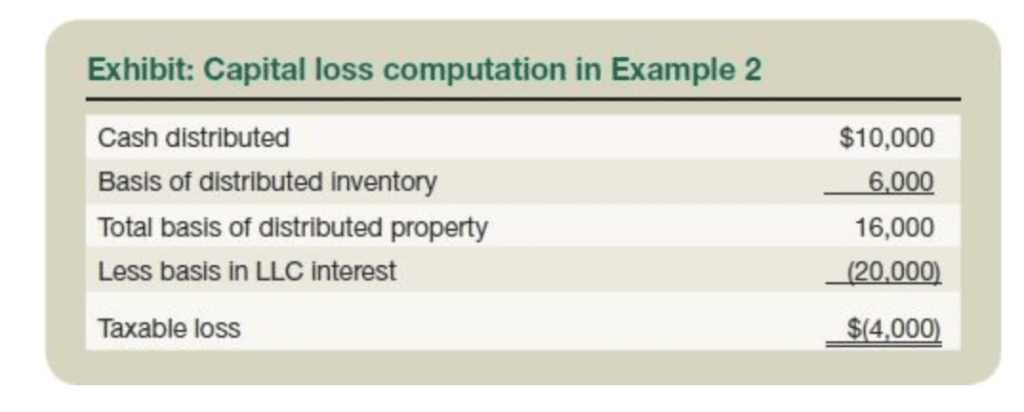

In some cases, this process can result in a capital loss for members. Here’s an example from The Tax Adviser:

Make sure you consult with your accountant on how to report these distributions for tax purposes properly.

Closing Your “Doors” and Moving Forward

Technically speaking, your LLC is officially dissolved after you complete the six steps listed above. With that said, there are a few other things you need to tighten up before you walk away from the business for good.

In today’s day and age, the term “closing your doors” can be a metaphor. Digital businesses may not have any physical space to walk away from. But they’ll still need to shut down their websites and other online pages and groups associated with the company.

For businesses operating in physical locations, you’ll need to lock your doors and clear out the space. Much of this can happen during the liquidation process (described in step 6).

If you’re on a commercial lease, you may be required to pay rent for the duration of that lease, although many leases have an early termination clause. Your landlord also might be willing to work with you if you give them enough notice.

Notifying your customers is also a good business practice when you’re dissolving an LLC. While this isn’t technically a requirement, it’s something you should do. Consider writing a letter or publishing a formal message to your customers, thanking them for their business and letting them know of your plans to close.

Here’s an example template for this type of notice:

This is really important for certain business types. For example, let’s say you run a local dry cleaning company. You don’t want to close your doors for good while customers still have clothes hanging on the racks waiting to be picked up. In cases like this, you might need to go the extra mile and have your staff start call customers to inform them of what’s happening.

If you’re planning to start a new business, either right away or in the future, don’t burn your bridges with existing customers.

Dissolving an LLC can be a painful process, especially if the reason for dissolution was due to a business failure. But don’t let that hurt your chances of succeeding down the road. Salvage relationships with your clients and let them know you’ll contact them in the future (if applicable).

Keep copies of your official records, too. From your LLC formation documents to tax documents, employment records, dissolution papers, and everything in between, you never know when you’ll need to present them.

What happens if a creditor comes after you for payment a year after the dissolution? How will you handle a discrepancy on your tax returns with the IRS?

Having quick access to your LLC records can make your life much easier.

Conclusion

Closing your business can be a tough choice. But you can’t just walk away without officially dissolving the LLC.

Failure to do so will leave you liable for taxes, annual fees, and other obligations associated with owning a business. Late penalties and fines will accrue over time. Make sure you tie up all loose ends before you walk away.

It’s in your best interest to plan for an LLC dissolution before it actually happens. If your LLC operating agreement fails to address the process for dissolution, you’ll need to follow your state laws for official procedures.

Always consult with your accountant and attorney when you dissolve an LLC.

from Quick Sprout https://ift.tt/3gk7jkD

via IFTTT