Whether you’re starting a new business, launching a new product, updating your pricing, or rolling out a new service offering, market research helps take the guesswork out of your decisions.

Without market research, you could end up wasting tons of money on an idea that the market hasn’t validated.

By taking the time to research your target audience, competitors, industry, and trends, you’ll have a much better understanding of opportunities in your niche.

Market research helps you identify consumer pain points so you can adjust your products and marketing campaigns accordingly.

This guide will explain everything you need to know about conducting market research so that you can get it right the first time—even as a complete beginner.

The Easy Parts of Market Research

Market research can be intimidating. But there are some quick wins you can start with to help you build momentum. Once you get started, the challenging parts of running market research won’t seem so difficult.

Researching industry trends and market statistics is the best place to start.

This is usually as simple as a Google search for “[your industry] + trends” or “[your industry] + statistics.” You should be able to find plenty of reliable and sound data about all aspects of your market for inspiration.

Then you can use those trends to start brainstorming ideas and improvements to your business before diving deeper into additional research.

Here’s a really simple example to showcase my point: Let’s say you’re running an ecommerce website. If you research the latest industry trends, you’ll quickly learn about the importance of mobile commerce, mobile apps for ecommerce sites, and the impact of page loading time on ecommerce conversions.

Then it’s just a matter of taking one aspect of what you learned and using that to perform more specific research. So you could take trends about mobile conversions and turn them into an A/B test to see which checkout flow yields the highest conversions.

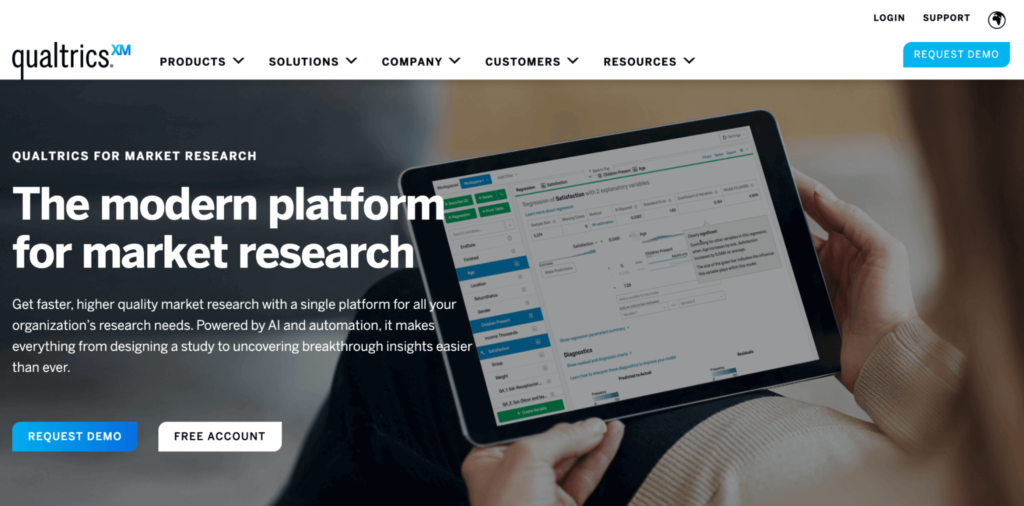

There are lots of simple tools and customer survey software out there that you can use to help aid your market research efforts. But Qualtrics is the best market research software for businesses that want an advanced solution.

Qualtrics is an online market research platform that provides you with all of the market research tools you need from a single provider.

It allows you to set competitive benchmarking, product development feedback, pricing research, purchase behavior analysis, and A/B testing. The software is great for researching market trends, forming research panels, and so much more.

Qualtrics is a data-driven way to conduct market research. The software also has tools to help measure your impact and track ROI.

More than 13,000 brands rely on Qualtrics for market research. You’ll even have access to market research experts and advisors. You can request a demo from Qualtrics to get started.

The Difficult Parts of Market Research

Validating theories is the hardest part of conducting market research. It’s easy to make assumptions about products and customer behavior. But the steps required to verify everything can sometimes be tedious and time-consuming.

In some cases, you’ll need to run multiple tests and experiments just to validate one theory.

Effective market research takes a lot of time and effort. You could spend weeks or even months conducting research before you’re properly equipped with the information you need.

Even after the preliminary research stage is over, you still need to analyze all of the data you’ve collected. This in itself is another challenge if your data hasn’t been organized into graphs, charts, and other visuals to measure trends.

It can be really frustrating after you’ve spent months on a particular experiment, gathering feedback, collecting survey responses, and conducting interviews—only to learn that your research was inconclusive.

Market research is an ongoing process. It’s not something that ends after you’re done writing a business plan or launching a new product. You need to conduct ongoing market research if you want to have a competitive edge in your industry.

Step 1: Get Organized Define the Purpose of Your Research

It’s tempting to dive right in, start analyzing trends and begin your experiments. But these efforts will be useless if you don’t have a specific sense of direction.

So take a deep breath, step back, and narrow your focus.

Why are you conducting market research? There are dozens of potential answers to this question. Examples include:

- Starting a new business

- Launching a new product or service

- Adjusting your pricing strategy

- Learning how your business is perceived compared to competitors

- Analyzing a new market opportunity

- Identifying your most profitable customers

- Learning if you’re meeting customer pain points

- Optimizing marketing campaigns and promotional materials

- Improving an existing product or service

- Assessing the market’s reaction to product packaging and logo designs

- Identifying new customers

- Setting realistic targets and benchmarks for your business

This list is essentially never-ending.

Sign Up For Market Research Software

Once you’ve identified the purpose of your market research, it’s time to equip yourself with the right tools and software to be successful.

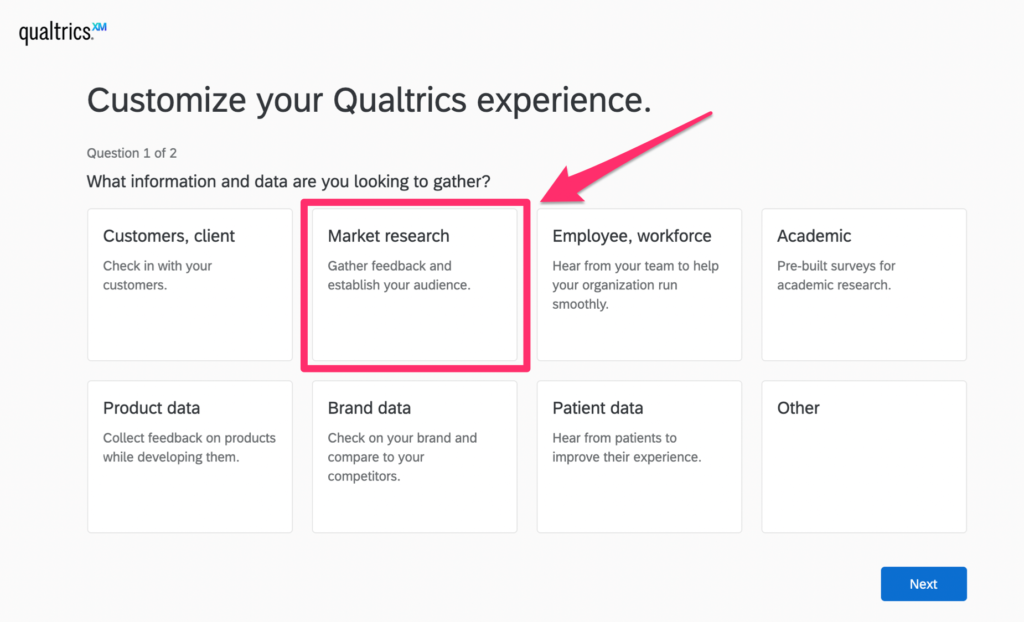

While Qualtrics for Market Research is definitely one of the more advanced solutions in the market research software category, you can still create a free account and start with basic use cases.

All you need is an email to create a free account for Qualtrics Surveys. It’s free forever, and no credit card is required to sign up.

The free plan comes with 50+ survey templates, eight types of questions, 100 responses, online reporting, and summary types. It’s an entry-level tool to get started with your market research.

To get an advanced plan from Qualtrics for market research, you need to request a demo and discuss your needs with their sales team. AI and automation power these advanced solutions.

Step 2: Identify Your Target Audience

No matter what type of market research you’re conducting, it all needs to circle back to your customers. This holds true for new market opportunities, general industry research, and any other reason you might have for doing market research.

After all, your main goal is to make money. You can’t do this without a firm grasp of your customers.

You need to understand that not everyone will be part of your target audience. Businesses that try to please everyone spread themselves too thin and rarely have success.

Start with an assumption of who you want to target, and you’ll ultimately validate those assumptions as you continue.

Create a Buyer Persona

Buyer personas take your target audience a step further. These help you create a deeper representation of your ideal customers. Start with some key characteristics like:

- Age

- Gender

- Location

- Income

- Occupation

- Marital status

- Family size

- Challenges and pain points

For example, let’s say your business sells footwear. You could narrow your buyer persona by targeting white-collar business professionals in major US cities making $90,000 to $149,000 per year.

The persona might narrow the focus even more to people who work in banking, insurance, and finance. The buyer’s problem is that they want comfortable shoes that still look professional while they’re at work and commuting around the city.

Segment Your Audience

The vast majority of businesses offer products and services that will appeal to different segments within a buyer persona. That’s perfectly normal.

For example, some of your customers might be couponers—people who only buy when you’re sending out a promotional offer. Another market segment example could be someone who is environmentally conscious. So when you target this persona, you’d want to show how your production process leaves a low carbon footprint.

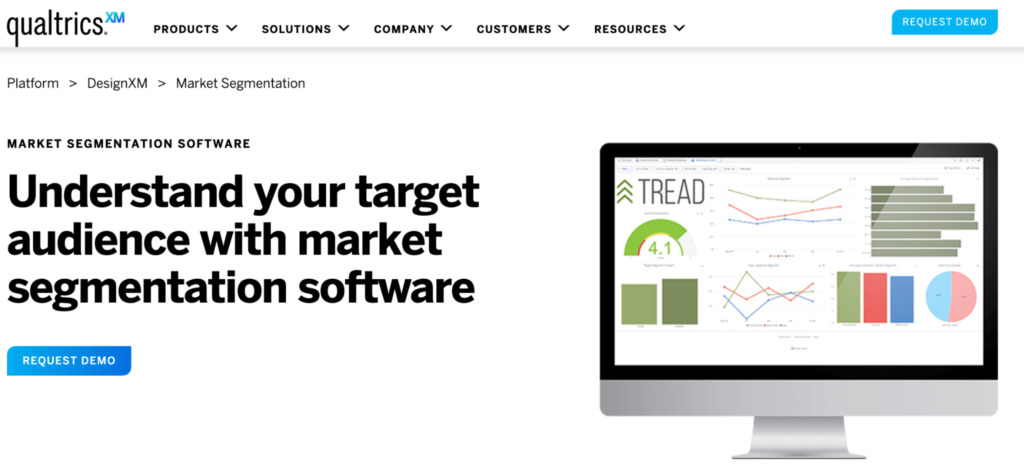

It can be difficult to segment your audience on your own, which is why it’s so valuable to use market segmentation software.

The software makes it easier for you to identify what’s working and what’s not working for each customer segment.

You can use it to drive demand with products and services designed specifically for each unique buyer persona. Qualtrics allows you to improve marketing campaigns by hitting the right target with the optimal message at the perfect time.

The software even helps you identify the best marketing channels for each segment. For example, some of your audience might prefer email communications, while others convert better when you send them a push notification from a mobile app.

Step 3: Gather Data

Now that you’ve clearly defined your purpose and narrowed down your target audience, it’s time to start collecting valuable insights.

Your data-gathering methods will vary based on what you’re trying to accomplish, your budget, buyer persona, and other factors.

Below we’ll cover some of the most popular options to consider.

Surveys and Polls

Surveys are one of the easiest ways to collect responses from the most number of people. They’re generally quick and don’t require your customers to go through too many steps to complete them.

Sometimes, you might need to provide people with an incentive to fill out a survey. Something like a percent discount or coupon off of a future purchase is usually enough to get the job done.

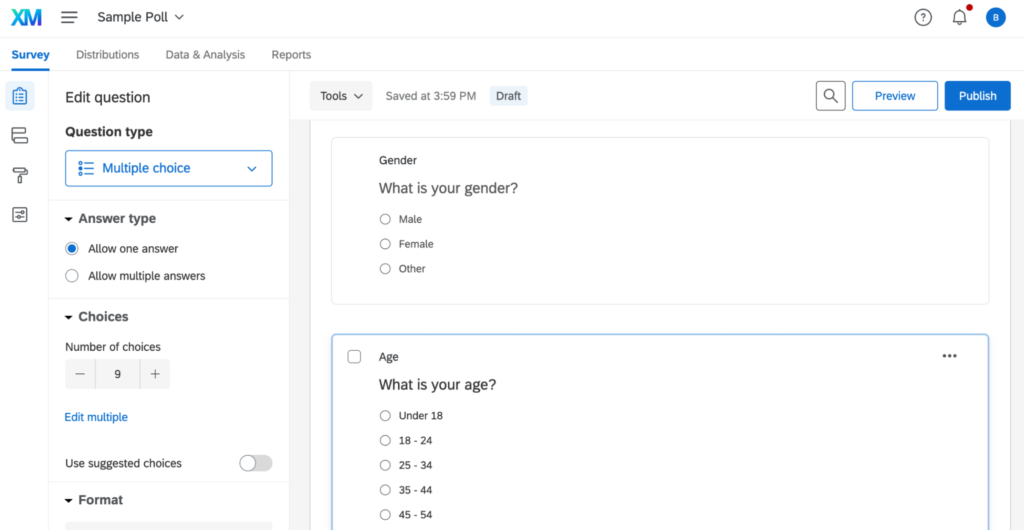

For example, here’s a sample demographic poll that you can create using Qualtrics.

You can use this template as a post-purchase survey to learn more about who’s buying your products or services. This can ultimately help improve your market segmentation, as we’ve previously discussed.

Interviews

Interviews are a bit more advanced than a survey. These are one-on-one discussions either handled in person or virtually. To keep things convenient for the interviewee, your interviews shouldn’t last more than five minutes.

If you have a brick-and-mortar presence, you might want to ask customers if they have time for a quick interview when they’re entering or leaving the store.

The benefit of an interview compared to a survey is that it allows for a more natural flow of data gathering instead of generalized survey responses. You also have the ability to assess body language, tone, and other factors during an interview to gauge the interviewee’s sentiment.

Focus Groups

A focus group involves a handful of carefully selected individuals. This is great for product testing, demonstrations, or feedback on specific ideas.

For example, you could use a focus group to test different product packaging options you’re considering.

Focus group sessions tend to be a bit longer than an interview but typically won’t be more than an hour per group. The best focus group sessions have a neutral moderator to help facilitate the discussion and encourage the users to provide as much information as possible.

Observation-Based Research

Observation-based research takes product and service testing to the next level.

For example, you can use software to monitor how users navigate your website. You can watch them go through your checkout process and identify areas where they got stuck. This is also a great way to determine how and when people abandon their carts or click away from your website.

Step 4: Identify and Research Your Competitors

Competitive analysis is a crucial aspect of doing market research.

Your business doesn’t operate in a vacuum. External factors, including your competition, will have a direct impact on how you make specific decisions.

Competitive research can help you figure out what customers think your competitors are doing well and what they need to improve. By filling in the market gaps you’ve identified, you can stand out from the competition and have the edge over these businesses.

For example, maybe all of your competitors target people with a certain income, but they’re ignoring a market segment that demands a lower price point. If you can reach that segment while still achieving profitable margins, you could have an opportunity to shine.

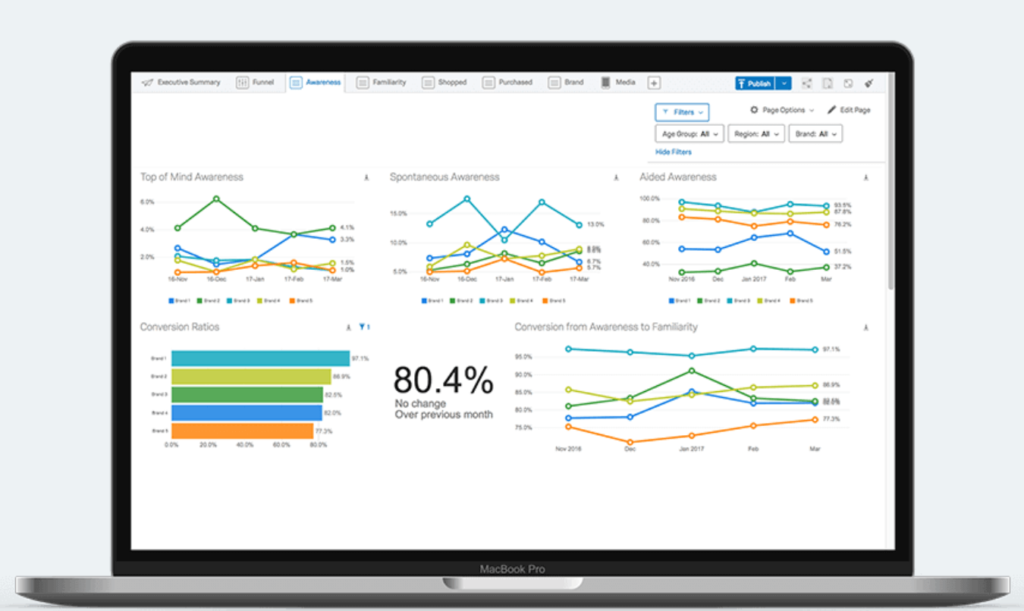

Qualtrics has a full-service research solution for competitive benchmarking.

This solution gives you a deep understanding of where you stand in relation to your competitors. You’ll learn more about the key differentiators to find opportunity gaps in products and services.

By outsourcing this task to the professionals at Qualtrics, you won’t have to do the lion’s share of the work on your own. You just have to sit back and wait for the report.

Step 5: Analyze Your Research

The final step of market research is the analysis phase. It’s time for you to digest all of the work you’ve conducted over the past several weeks or months and make sense of the information.

This is much easier when your findings are organized into reports, charts, graphs, and visuals.

That’s another advantage you get when you’re using market research software like Qualtrics.

Examples of findings you might discover in your market research could be:

- Forecasted business growth

- The price your customers are willing to pay for your products

- Types of customer groups

- Industry buying trends

- Your market share percentage and projected market share percentage

- Industry size and industry growth rate

- Discounts and promotions you plan to offer

- Marketing campaign ideas

After analyzing the market research, it’s time to put your findings into action with data-driven decisions.

from Quick Sprout https://ift.tt/3D7TqPE

via IFTTT