If you’re wondering how to start a bookkeeping business, you’re in the right place.

Bookkeeping is a very in-demand service. Despite being smart and successful, so many people have a hard time organizing their books.

And since any disorganization where finance is concerned spells disaster, business owners are always looking for a reliable bookkeeper.

If you have a knack for numbers, are familiar with popular accounting and bookkeeping software, and have a good head for organization, you’re on the right track.

Here’s a beginner’s guide to help you start your own bookkeeping business.

The Easy Parts of Starting a Bookkeeping Business

The easiest part about starting a bookkeeping business is getting started.

With minimal startup costs and no hard requirement for formal education, becoming a bookkeeper isn’t complicated. As long as you have a high school diploma and understand bookkeeping basics and software, you’re good to go.

If you choose to receive specialized knowledge and get yourself certified, it’s only going to boost your marketability and appeal. Additional certifications are great to build credibility in the prospect’s eyes and charge more for your services.

Access to tons of amazing modern booking tools is another advantage.

Most bookkeeping and accounting software is highly advanced and intuitive, which significantly reduces the possibility of making errors. Plus, you don’t have to worry about demographic restrictions.

You can work virtually from anywhere and enjoy a broad target market as these tools let you work with any client, irrespective of the time zone.

The Difficult Parts of Starting a Bookkeeping Business

You can use advanced bookkeeping, accounting, and practice management software to streamline workflow and minimize errors—provided you have the money to pay for them.

Most of these tools are expensive, which can be heavy on the pocket. While there are cheaper options available, there’s no guarantee they’ll be as efficient as their premium counterparts.

Also, while advanced software reduces the possibility of errors, it doesn’t completely eliminate them.

You have the huge responsibility of looking after your client’s books and ensuring it stays secure and away from unauthorized eyes. Committing any error will put you at the risk of getting sued, ending with you paying hefty fines and penalties. It’s also possible you may be asked to shut down the business.

Then again, there are pros and cons to every business, and in the bookkeeping niche, the pros far outweigh the cons.

Step 1: Get Yourself Certified

You don’t need any special training or experience to become a good bookkeeper. A high school diploma is enough to get started.

But getting more education will give you more credibility, proving you have the necessary knowledge to do bookkeeping, payroll, and even tax returns. This is precisely why I recommend adding to your credentials to put your best foot forward.

Here’s a list of certifications to set yourself up for success:

Certified Bookkeeper

As the state doesn’t regulate bookkeeping certifications, you must get certified by large, reputable organizations. Otherwise, your certificate will be meaningless and may not be respected by prospects.

I highly recommend the following two professional bookkeeper organizations:

American Institute of Professional Bookkeepers (AIPB)

This bookkeeping certification is ideal if you don’t have any formal education in the bookkeeping and accounting field.

You have to pass a certification exam and meet a 3000-hour work experience requirement to become AIPB-certified. Once you get certified, you can put the credential CB (which stands for Certified Bookkeeper) behind your name and display it on your resume and business cards.

National Association of Certified Public Bookkeepers (NACPB)

To become NACPB-certified, you have to take various courses in bookkeeping, payroll, QuickBooks Online and be familiar with accounting principles. You must pass the exam for every course, too.

Additionally, you’ll need one year of experience before applying for the course. That said, you can substitute experience with your college accounting courses, but you’ll still need to pass each exam.

You’ll earn the credentials CPB (which stands for Certified Professional Bookkeeper) on getting certified.

Accounting Software Certification

Many popular accounting software tools offer certification programs to help bookkeepers demonstrate their proficiency with that software. For instance, QuickBooks has QuickBooks ProAdvisor, FreshBooks has FreshBooks Partner Program, and Xero offers Xero Partner Program.

Step 2: Choose Your Target Market and Niche

In business, having a strategic plan is always better than “winging it.”

Once you figure out your purpose, you’ll know who your ideal clients are, their pain points, and how to approach prospects to convert them into paying clients.

Define Your Purpose

Figuring out why you want to start your business will help you clarify your business’s purpose to you and your clients.

Your purpose doesn’t have to be complicated. It can be as simple as “I want to give entrepreneurs a seamless and easy accounting and bookkeeping experience.”

No need to overthink it, but you do want to have a purpose, which can also double as your mission statement.

Pick Your Niche

Bookkeeping is applicable across all industries. After all, every business owner has to keep track of and optimize their finances.

When it comes to business success, however, taking a general approach seldom works. Instead, you should choose and specialize in a specific industry. Not only will you make more money, but it’ll also help you identify your target market.

Define Your Target Market

After defining your firm’s purpose, you need to figure out your ideal client profile—something you can do by developing a persona for your target client.

To do this, consider the following questions:

- What industries do your target audience belong to?

- What challenges do they face?

- How many employees do your clients have?

- What is their total revenue?

- How would you define their thought process?

- What do you think appeals to them most?

Step 3: Create a Business Plan and Price Your Services

You’ll chalk out a business plan for your bookkeeping business in this step.

Business plans are an intention or a series of intentions you have for your business. It involves outlining your goals and the services you plan on offering for your business in detail. Knowing your business and personal goals will help you price your services better.

Draft Your Business Plan

Having a defined business plan also helps you flesh out your competitive advantage over rivals and create projections and strategic growth plans for maximum efficiency. Here are the key items that you should include in your business plan:

- Cover page

- Executive summary

- Company overview

- Competitive analysis

- Marketing plan

- Startup costs

- Financial protection

You can check out my guide to How to Write a Business Plan for Your Startup to learn how to create a viable business plan.

For a bookkeeping business, in particular, there are two parts of the business plan that deserve special attention:

Your Business Name

Your business name is the first thing prospects hear about your bookkeeping enterprise. Exactly why you must consider this very carefully.

Think about what you want to communicate with your business name? Expertise? Your specialty? Maybe you want to talk about your personality?

When shortlisting business names, don’t forget to run it by your friends and family to hear their opinions. Once you finalize an option, run a quick check through your Secretary of State’s business name database to make sure it’s available.

Highlighting Certifications

If you have extra certifications that highlight your professional skills, you should certainly mention them in your business plan. This allows you to differentiate yourself in an already competitive market, attracting more clients. Yes, this also includes software-certified certifications.

Price Your Services

Think about how much you want to charge for your bookkeeping services.

According to Payscale, the average hourly rate for a bookkeeper is about $18 per hour—$12 on the lower side and $25 on the higher side. But before any figures, you should understand your fees should reflect your experience, expertise, notifications you carry, and your operating location—and not some statistic.

Consider any fees you pay for software and other tools, and do plenty of research on average bookkeeping costs in your geographic area and industry. You want to be competitive, but not the highest or the lowest prices in your area and industry.

Step 4: Register Your Bookkeeping Business and Get Insurance

Registering your bookkeeping business makes things official. The process to do so will vary depending on your plans to structure your business and where you plan to do business, so it’s best to look up the exact rules to avoid running into problems.

Select a Business Entity

Before business registration, you must decide your business entity or legal structure. Your choices include sole proprietorship, corporation, limited liability company (LLC), partnership, and so on.

The business structure you choose will directly affect the amount of taxes you pay and the extent of your liability protection if your business is ever sued. I recommend looking into sole proprietors and LLC options. The latter gives you the flexibility to bring in more people in the future.

Here is a guide to business structures to get you started and explain the different types of structures you can choose from.

Get Your Business Insured

Although not compulsory, you should consider insuring your bookkeeping business to protect yourself from costly liability in case you make a mistake on your customer’s books.

Bookkeeping is risky. Even a single mistake can be a massive hit to your business, your client’s business, and sometimes, even your personal finances. It’s best to look into standard business insurance policies for bookkeepers to stay on the safe side.

Step 5: Set Up Your Business Infrastructure

You need a few critical pieces of infrastructure before kicking off your business, namely, your website and business bank account.

Create Your Bookkeeping Business Website

Think about it: have you ever hired someone or bought anything from a company that doesn’t have a functioning website?

Exactly.

Your target customers will want to look at your website to learn more about you and your experience. This becomes even more important if you plan on running a completely virtual business.

You can use a web builder like Wix and WordPress to have your website up and running in no time. What’s more, these tools are incredibly cheap compared to hiring an actual web designer or developer.

Make sure to showcase your skills and any certifications you have, and put up any testimonials from existing or previous clients. These show potential clients your skills and experience.

Set Up a Business Bank Account

You should set up a business bank account to separate your business’s finances from your personal finances. Doing this will also secure your personal liability protection.

Most bookkeepers wait until the business starts to generate cash flow to make a business bank account. That’s wrong.

You see, your expenses start the moment you register your business, and you need to keep track of them so they can be deducted as startup costs.

You should also consider applying for a business credit card to track your business expenses and raise funds.

Step 6: Invest in the Right Software

This step is a no-brainer.

Software tools are the very foundation of your business, which is why you should try to select the best tool—whether for accounting and bookkeeping, payroll, or file sharing—for your bookkeeping business.

To get you started, here are the four categories of software tools most used by bookkeepers:

Bookkeeping or Accounting Software

I’m going to go ahead and assume you’ve already decided on a bookkeeping/accounting software for your business. But if you haven’t, there is no need to panic.

There are tons of fantastic software designed to cater to every need a business owner could have. My top recommendations, however, would be QuickBooks Online or Xero because of their user-friendly interface and integration facilities.

Plus, both software options offer specialization courses—something that can work in your favor.

Payroll Service

Depending on the bookkeeping/accounting software you select, you‘ll find a payroll processing feature you can use when hiring employees. QuickBooks is a shining example of this facility.

Otherwise, you can opt for other online payroll services like ADP and Paychex that can help you pay your employees accurately and on time. If you don’t want to deal with payroll or don’t plan to hire employees to work under you, skip this tool.

File Sharing Service

With workforces going remote, a file sharing service or document sharing system has become more critical than ever.

These systems allow you to share information, such as bank statements, invoices, copies of the receipt, and accounting files with your clients, regardless of their location. This can work wonders to eliminate bottlenecks and streamline operations.

I highly recommend Dropbox, which is an excellent document-sharing tool to store and send your files securely.

You can create a Dropbox for every client, asking them to submit their information there. All parties will need a user ID and password to access the information. Plus, there’s no need for backup as all the data is stored on the cloud.

Practice Management Software

Practice management software can be life-saving.

You can use it to organize and track work progress and create a portal to access your client’s books without leaving your home. Luckily, both Xero and QuickBooks offer practice management software that can be integrated into the main accounting software.

Step 7: Market Your Bookkeeping Business

Marketing is one of the more difficult things for a bookkeeper to master. You have to figure out effective strategies to find customers and get the ball rolling.

The good news is you already have a website, so you can focus on other tactics to increase your clientele.

Figure Out Your Unique Selling Proposition (USP)

You may already know your USP when creating your business plan. If you don’t, consider the following questions:

- Are you leveraging your experience in the bookkeeping industry?

- Are you touting your industry specialization?

- Do you want to work on a freelance basis, or are you looking for long-term contracts?

- Are you interested in national work, or are you only open to working with local businesses?

Answering the above and other similar questions will help you brainstorm creative ways to market your business.

Try Out Networking Strategies

Once you know your USP, try to leverage it to attract more clients.

For example, you can attend local networking events and conferences frequented by your target audience. Start mingling with people and talk about your business. Be sure to carry some business cards with you and hand them out!

You can also leverage LinkedIn. Seek out relevant LinkedIn groups, reach out to potential clients, or put up posts stating you’re open for business and looking to take on more bookkeeping clients.

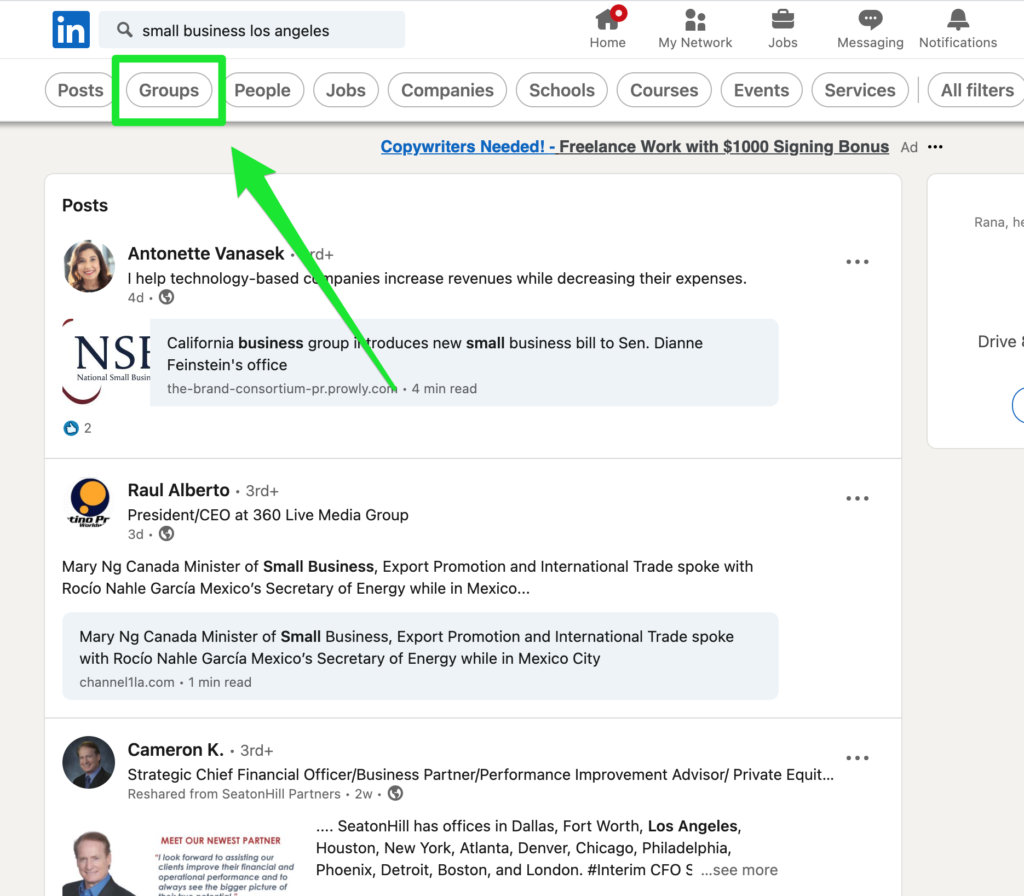

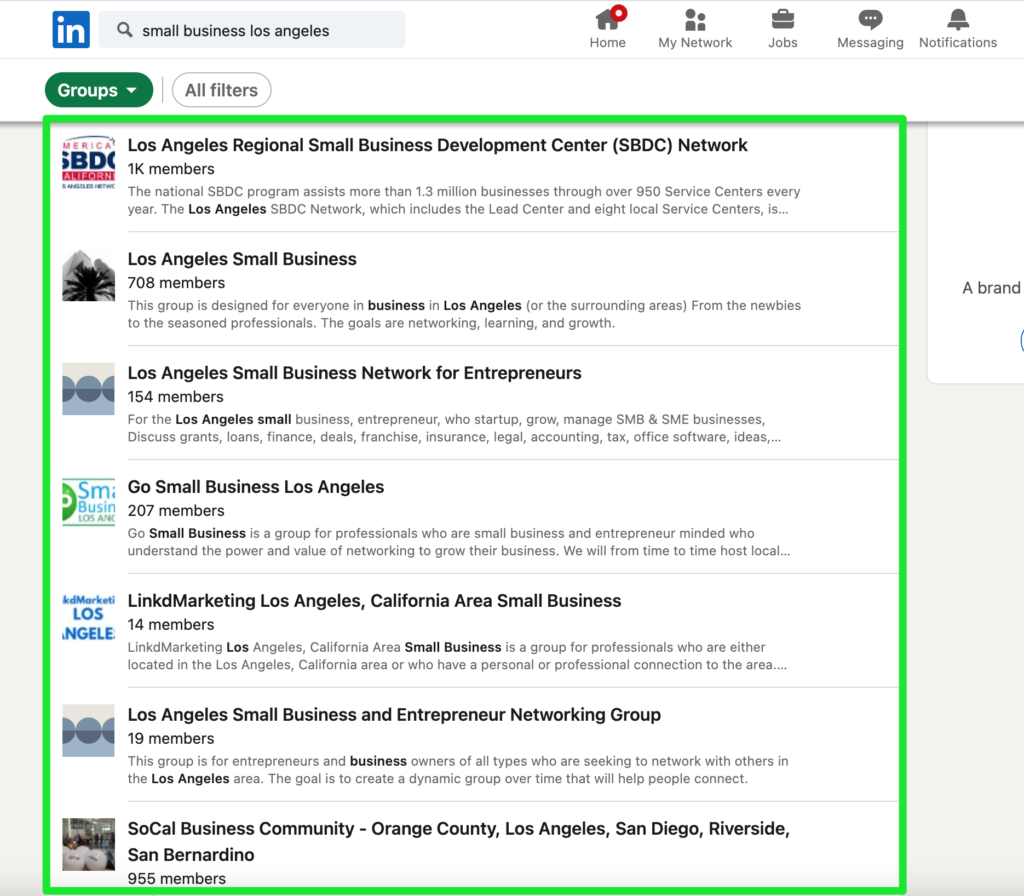

Here’s a tried-and-tested way to get more clients on LinkedIn:

- Open the LinkedIn search bar and type in a few keywords that describe your target audience. Example: small businesses Los Angeles

- Click on the Groups tab located on the top menu bar to filter results.

- You’ll see a list of groups relevant to your keywords. Target the ones that appeal to you most and submit a request to join them.

Once you get accepted, start contributing and engaging with these groups regularly to establish yourself and your authority. Instead of blatant self-promotion, share thought-provoking posts or leave valuable comments on group posts to get people to notice you.

from Quick Sprout https://ift.tt/3lURFiB

via IFTTT