Delaware is a popular state for entrepreneurs who want to start an LLC.

It has predictable, business-friendly laws and an affordable and easy LLC formation process.

But before you start an LLC in Delaware, you must fulfill some unique requirements.

Registering with the division of corporations, paying the required fees, meeting all naming information prerequisites… there’s much to be done.

Below, I’ve created a step-by-step guide to help you start a Delaware LLC and get your business up and running.

Read on for everything you need to know to get started.

The Good Parts of Starting an LLC in Delaware

Unlike in some states, owner information is kept confidential in Delaware.

You don’t have to disclose anything about yourself or other owners. If anyone tries to find out information about your financial situation or tries to sue you, they cannot learn about your ownership interest by checking the Delaware LLC records.

The simplicity of the LLC formation process is another benefit.

You only have to file a Certificate of Formation with the Division of Corporation and pay a nominal filing fee. Plus, many LLC services like IncFile offer well-rounded LLC services in the state, further reducing any stress on your part. I’ll discuss this in more detail later.

Delaware offers owners the ability to set up a series LLC to allow a single LLC to have numerous divisions (known as series), with each division operating as a separate entity, complete with its own assets, members, and liability limitations.

If any series gets sued, the assets of other series will remain protected.

What’s more, you don’t have to pay any state income tax or intangible property tax, unlike most of the other states.

The Bad Parts of Starting an LLC in Delaware

If your primary place of business is a state other than Delaware, the registration process will be slightly more tedious.

You’ll have to register as a foreign entity in your home state, which involves multiple filing fees and annual reporting requirements. You may also need to obtain a Certificate of Good Standing from Delaware, which again costs a nominal sum of money.

Multiple-state registration and reporting also require having a registered agent in both Delaware and your home state.

While many LLC services offer registered agent services across the United States, you have to be careful to choose the right one. Otherwise, you’ll find yourself juggling different agents in different states.

Although convenient, the fact that Delaware allows an oral LLC operating agreement can cause problems in the future. Conversations between LLC members can be construed and involved parties may go back on their word.

Keeping this in mind, it’s better to have a written operating agreement, even when it isn’t required by law.

Step 1: Finalize the Name of Your Delaware LLC

Choosing a name is the first step in your LLC formation journey.

In Delaware, selecting the right business name isn’t just about branding—you also have to meet specific legal requirements. Checking availability to ensure no other business has filed for it with the Division of Corporations is another necessity.

Follow the Naming Guidelines

Similar to other states, Delaware law requires business owners to select a unique name for their LLC. But there are other guidelines to keep in mind too, such as:

- LLC name must be distinguishable from other Delaware LLCs, corporations, and partnerships

- LLC name must include the phrase “limited liability company“ or one of its abbreviations (LLC or L.L.C.)

- LLC name cannot include words that could potentially confuse your company with a government agency (Treasury, FBI, State Department, etc.)

- You’ll have to file additional paperwork and have a licensed individual, like a doctor or lawyer, if the LLC name includes restricted words (Bank, Attorney, University, etc.)

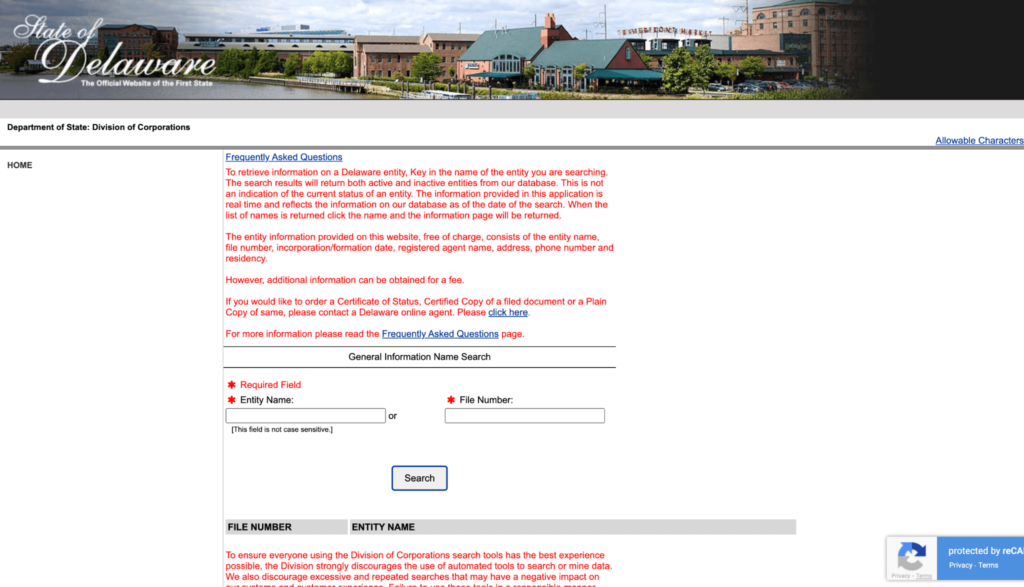

Check Name Availability

You’ll get hit with a penalty if you use a name that another Delaware business is already using. Make sure to search the name you want on Delaware Entity Search on the Department of State’s website. If the name is available, you can use it. If someone else already has it, you’ll need to come up with a different name.

Check URL Availability

You may have already thought about launching a website for your business. Even if you haven’t, it’s better to check and see if your business name is available as a web domain.

If you don’t plan to create a business website right away, I still recommend buying the URL to prevent other businesses from acquiring it.

Registering for a DBA (Optional)

You can operate your LLC under a name that’s different from your company’s legal name.

In this case, you have to register a DBA or “doing business as” within the Delaware county with which you do business. Fill up the Registration of Trade, Business & Fictitious Name Certificate form, and file it with each county Superior Court where you do business.

Keep in mind you’ll have to pay a $25 filing fee for this form, and it must be notarized.

Step 2: Nominate a Registered Agent in Delaware

It’s mandatory to nominate a Delaware registered agent for your company if you want to start an LLC in the state.

A registered agent is an individual or business entity who receives important state and federal correspondence, tax forms, notice of lawsuits, and legal documents on behalf of your business. They are your business’s point of contact with the state.

Additionally, this person or business entity must be a state resident or business entity with a street address in Delaware.

While you can elect yourself as your company’s registered agent, I’ve found hiring an LLC service that offers reliable registered agent services is more convenient. Here are my top three picks:

Incfile

Incfile takes the #1 spot on our list of the best LLC services, and not without reason.

It offers an extensive library of material to help budding entrepreneurs figure out what kind of businesses they should set up. It then assists them with documentation and filing procedures—all available for as low as $0. You only have to pay the state fees.

What’s more, you get free registered agent services for the first year.

Rocket Lawyer

If you’re looking for a wide range of online legal services, look no further than Rocket Lawyer.

This LLC service offers free formation filing, legal documents, and up to 30-minute consultations on every new legal matter. I specifically recommend Rocket Lawyer for users wanting access to highly experienced attorneys to answer their post-business formation questions.

The fact you get 25% off on registered agent services makes it affordable too.

ZenBusiness

You never have to worry about your paperwork when you work with ZenBusiness.

The company offers a wide range of LLC services and ensures your business is set up correctly with the proper paperwork filled out and delivered to the right state authorities.

ZenBusiness plans include services like LLC documents preparation and filing, online document access, name availability search, and of course, registered agent services.

Step 3: File Your Delaware LLC Certificate of Formation

Next, you have to file your Certificate of Formation (also known as the Articles of Organization in other states) online with the Delaware Division of Corporations and pay a filing fee.

Since you’ve already hired an LLC service to look after your documentation, you don’t have to stress too much about this. But since it’s a necessary step, I’ll explain it in more detail.

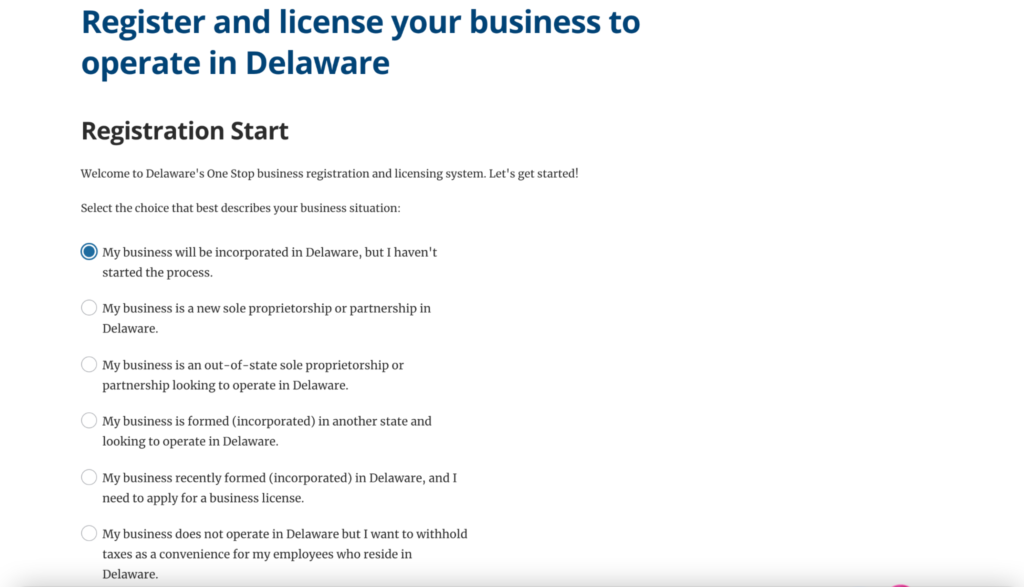

Obtain a Delaware Business License

Delaware has strict requirements for business licenses. You must obtain a state business license from the Delaware Department of Revenue.

To get a business license, you have to create a “One Stop“ account and pay a filing fee. The fee amount will vary based on the type of business you run and can cost anywhere between $50 and $450.

After completing the process online, you’ll receive a temporary license that’s valid for 60 days. Permanent licenses are generally sent within 10 days.

Some Delaware cities and counties may require you to get additional licenses. Therefore, it’s best to contact local government agencies and find out if you’ll need additional licenses to operate your LLC in Delaware.

File the Delaware LLC Certificate of Formation

You can file the Certificate of Formation by either filing it online with the Delaware Department of State or by mail.

You’ll have to submit your business’s name and information regarding your registered agent when filing, plus it must be approved by the Delaware Secretary of State.

Delaware law requires you to file a Certificate of Formation only once. But you’ll have to file a Certificate of Amendment and pay the requisite fee if you make any changes to your business’s name or your registered agent down the line.

Store Certificate of Formation Safely

Keep your Certificate of Formation, along with your other important documents, safely once you get the paperwork back after approval. This may seem obvious, but you’ll be surprised at how many LLC owners misplace important documents. Don’t be like them.

Step 4: Create Your Delaware LLC Operating Agreement

Upon receiving approval from the Division of Corporations, you now officially have a Delaware LLC. Congratulations!

However, you still need to take a few additional steps before getting the final go-ahead. For instance, Delaware LLC owners have to adopt an operating agreement.

An operating agreement is a legal document outlining the business ownership and operating procedures of a specific LLC. It helps ensure all business owners are on the same page, hence reducing the risk of future conflicts and misunderstandings.

While the law doesn’t specify when you have to enter into the agreement, it’s common practice to do so soon after filing your Certificate of Formation. Again, you can have a verbal agreement, but it’s best to have a formal, written operating agreement.

Draft the Operating Agreement

An operating agreement is a comprehensive document. It should clearly describe your business structure, establish the individual responsibilities and obligations of every member, and detail how the LLC will be run.

At the very minimum, your operating agreement should include the following information:

- Purpose of forming an LLC, including products and services on offer

- Names and addresses of every LLC member, as well as the manager if applicable

- Each member’s contribution of value to the LLP

- Every member’s ownership interest, voting rights, and share of the profits and losses

- Procedure for admitting new members

- Procedure for electing a manager (if the LLC is manager-managed)

- Meeting schedule and voting procedures

- Dissolution process

Every LLC member should review and sign the operating agreement. You don’t have to file the document with the state, so you can store it with other important business records.

Step 5: Comply With Federal, State, and Local Regulations

The last step to start an LLC in Delaware involves complying with all applicable federal, state, and local regulations. Some of these regulations may vary based on your specific location and the nature of business, but here are the most important regulations to keep in mind:

Apply for an EIN

EIN stands for Employer Identification Number, which is a nine-digit number assigned by the Internal Revenue Service (IRS) to identify businesses for tax purposes. Think of it as a Social Security number for your business.

Although not mandatory for all LLCs, you’ll need an EIN if you have multiple owners, plan on hiring employees, or want to be taxed as a corporation. It’s also required to open a business bank account.

Sort Out Your Tax Obligations

Delaware doesn’t have a sales tax, but you have to fulfill other tax requirements as an LLC operating in the state. You have to pay federal taxes and state taxes, as well as self-employment taxes and payroll taxes if you have employees.

Additionally, all Delaware LLCs must pay an annual tax of $300 and gross receipts taxes (ranging from 0.0945% to 0.7468%) depending on your business type. Every member of the LLC also has to pay state income tax on their personal tax returns, unless they elect the LLC to be taxed as a corporation.

Meet Your Employer Obligations

If you hire employees, you’re required to meet specific employer requirements, such as reporting new hires, paying payroll and unemployment taxes, and buying worker’s compensation insurance.

In fact, all Delaware employers must register with the Division of Workers’ Compensation and purchase worker’s compensation insurance after they hire their first employee, regardless of whether the employee is full-time or part-time.

from Quick Sprout https://ift.tt/3hB5yzv

via IFTTT