Want to jump straight to the answer? The best payment processor for most people is definitely Square.

In order to operate a fully functional ecommerce website, you need to be able to accept payments from your customers.

There is no way around this. Your entire business revolves around getting paid.

That’s why you starting selling online in the first place, right? To make money.

But there are tons of different options for accepting payments online. Whether you have an existing ecommerce platform or if you’re starting an ecommerce site from scratch, your payment gateway needs to be a priority.

You need to have options in place that will be appealing to all of your customers.

Compare Quotes From The Best Credit Card Processing Services

Get matched up with a credit card processing service that fits your needs.

Compare Quotes

That’s because everyone has different preferences. So you should consider adding multiple payment methods to your ecommerce site.

I realize that not all of these options will be equal in terms of the cost that you’re paying to implement them on your site. But in the long run, those fractions of a percentage won’t make that much of a difference when you weigh them against the revenue from your sales.

You won’t think twice about it once your conversion rates start skyrocketing.

For those of you who are ready to take your ecommerce platform to the next level, I’ve narrowed down the best payment methods for a fast and secure checkout process in 2020. These are the top options for you to consider.

1. Square

Ability to get paid fast

Fraud prevention

Straightforward pricing

Get Started Now

Square is commonly associated with its POS systems for in-person payments. But it also has ecommerce options for your website.

This is a great choice for those of you who have physical retail locations and plan to start selling online, especially if you already have a Square POS system. It’s also a great option if you’re planning to open retail locations in addition to your ecommerce shop.

Square is priced competitively compared to the other methods on our list.

There is no monthly fee for adding the Square payment gateway to your website. They charge you 2.9% + $0.30 per transaction, just like Stripe and PayPal.

Integrating Square to your ecommerce platform is easy. Some of their ecommerce partners include:

- Wix

- WooCommerce

- GoCentral Online Store

- Ecwid

- 3DCart

- OpenCart

- Magento

- Miva

- Drupal Commerce

- X-Cart

- Zen Cart

- ShipStation

- Mercato

- Unbound Commerce

- WordPress

- nopCommerce

- WP EasyCart

- Sociavore

So if you’re currently using one of these platforms for your ecommerce shop, adding Square will be a breeze. Click here to learn more at Square.

2. Stripe

Built for developers

API and UI toolkit

Wide range of payment options

Compare Quotes

Stripe is one of the top payment methods on the market today because it’s so versatile.

It’s a great choice for ecommerce shops, subscription services, or on-demand marketplaces. So for those of you who operate a business with multiple processes and services, this is definitely something that you should take into consideration.

Another top feature of Stripe is the ability for you to set up recurring payments from your customers.

It supports payments online, as well as in-person. So if you currently have a brick and mortar store, you can add a Stripe POS system in addition to the gateway on your ecommerce site. This way you can remain consistent across both marketplaces.

Studies show that brands using Stripe have increased revenue by 6.7% after implementing the payment gateway. With Stripe, you’ll have 81% fewer outages and 24% less operating costs compared to competing payment methods.

Another reason why I love Stripe is because you’ll have the option to customize your checkout process with the Stripe UI toolkit.

Stripe accepts all major credit cards and debit cards from all countries, including:

- Visa

- Mastercard

- American Express

- Discover

- JCB (Japan)

- UnionPay (China)

You can also integrate some alternative payment options into your Stripe payment gateway. Some of these we’ll discuss in greater detail as we continue through this guide.

- ACH transfers

- American Express Checkout

- Masterpass

- Visa Checkout

- Apple Pay

- Google Pay

- Microsoft Pay

It’s great for those of you who are using your ecommerce platform to drive sales from mobile users.

Stripe’s standard pricing is simple. As a merchant, it will cost you 2.9% + $0.30 for every card charge. There will be an additional 1% charge for international cards.

For ACH transfers, your cost is 0.8% of the transaction with a $5 maximum fee.

Additionally, Stripe offers customized pricing options for those of you who have a unique business model or have large volume payments. You’ll get discounts for volume and multi-product rates, as well as some country-specific rates if you’re targeting an international market.

Stripe has exceptional tech support and customer service. You can reach representatives 24/7 via phone, live chat, or email. Overall, it’s definitely one of the top payment methods for you to use on your ecommerce site.

3. PayPal

Trusted well-known brand

Online or in-person payments

Extremely easy to set up

Compare Quotes

PayPal is a name that I’m sure most of you are already familiar with. The company has a reputation that speaks for itself when it comes to ease of use, reliability, and security.

This is why you should consider adding PayPal to your website.

According to Statista, there are 277 million active PayPal users across the world in 2019. That number is up from 237 million from the beginning of 2018.

Simply put, there are tons of users, and they are continuing to grow.

For those of you who don’t have a well-established name brand yet, the PayPal button can help put your customers at ease. They know that PayPal has their back for security.

Plus, people might have a PayPal balance that they want to use for spending, as opposed to charging a credit card or debit card.

PayPal is the most commonly used digital wallet in the world. Here’s something else for you to consider.

Websites with PayPal checkout options convert at an 82% higher rate than sites without PayPal.

With PayPal for ecommerce you can accept:

- Credit cards

- Debit cards

- PayPal

- Venmo

- PayPal Credit

Any ecommerce sale in the US will cost you 2.9% + $0.30 per transaction. International sales are a bit more expensive, with 4.4% per transaction, plus a fixed amount depending on the country the purchase came from.

4. Apple Pay

Trusted well-known brand

Online or in-person payments

Extremely easy to set up

Compare Quotes

Apple controls over 54% of the mobile vendor market share in the United States. So it’s safe to say there are more than a fair share of people in America walking around with iPhones in their pockets.

Apple Pay is the digital wallet for iOS users.

Once people set it up on their devices, they can pay for items with just one click. This is great news for your ecommerce shop. You no longer have to worry about people being turned off by filling out long form fields with their credit card numbers and billing addresses.

All of that information is safely stored in Apple Pay.

For users who are shopping on your mobile site or mobile app, they can finalize the payment just by using a fingerprint or facial recognition. It doesn’t get much easier than that.

In addition to your ecommerce site, mobile site, and mobile app, Apple Pay can also be accepted in-person at brick and mortar stores.

One of the top highlights of this payment gateway is the fact that Apple doesn’t charge any additional fees to merchants for accepting Apple Pay.

5. Leaders Merchant Service

• 24/7 phone and live chat support

• Online credit card processing

• Low prices

• FREE mobile card reader

• Compare quotes

Leaders Merchant Service is a California-based merchant hardware and software service. They provide companies and businesses with the tools they need to process payments online and in real life.

To that end, they offer a variety of very lucrative deals for anyone looking for payment processing help. If you open an account with them, you have your choice of receiving a free mobile card reader for a smartphone or tablet, or a free online processing software. That’s all just for opening an account.

When you open an account, you also get iAccess, which is a payment management tool online that helps you keep track of all your transactions. This will help keep everything recorded for if you ever need to refer back to a payment for disputes or returns.

Their security is top notch too, as they’re fully compliant with Payment Card Industry standards. There’s also “end-to-end secure socket layer encryption, address verification, and card verification value authentication,” according to their website. That way, you know that any card payment processed with Leaders is safe from bad actors.

You can request a quote online or by calling their number. They have a 98% approval rating so you can bet that Leaders will help you get your business payments up and running soon.

6. ProMerchant

• Online credit and debit card processing

• Month-to-month contracts

• Shopping cart integration

• Virtual terminal

• Compare quotes

Boston-based ProMerchant offers a host of great merchant processing solutions including a virtual terminal that comes with no up-front costs to you. That means there’s no up-front cost when you accept credit card payments via phone, email, text, or your website’s “buy now” button.

For ecommerce sites, ProMerchant leverages Authorize.net for actual payment gateway. This allows you to accept payments across a variety of different credit cards and payment options:

- Visa

- Mastercard

- Discover

- American Express

- JCB

- PayPal

- Visa Checkout

- Apple Pay

- E-check

ProMerchant’s virtual terminal also allows you the flexibility of accepting transactions over phone, email, mail, and even text messages. That gives your customers even more opportunities to pay you.

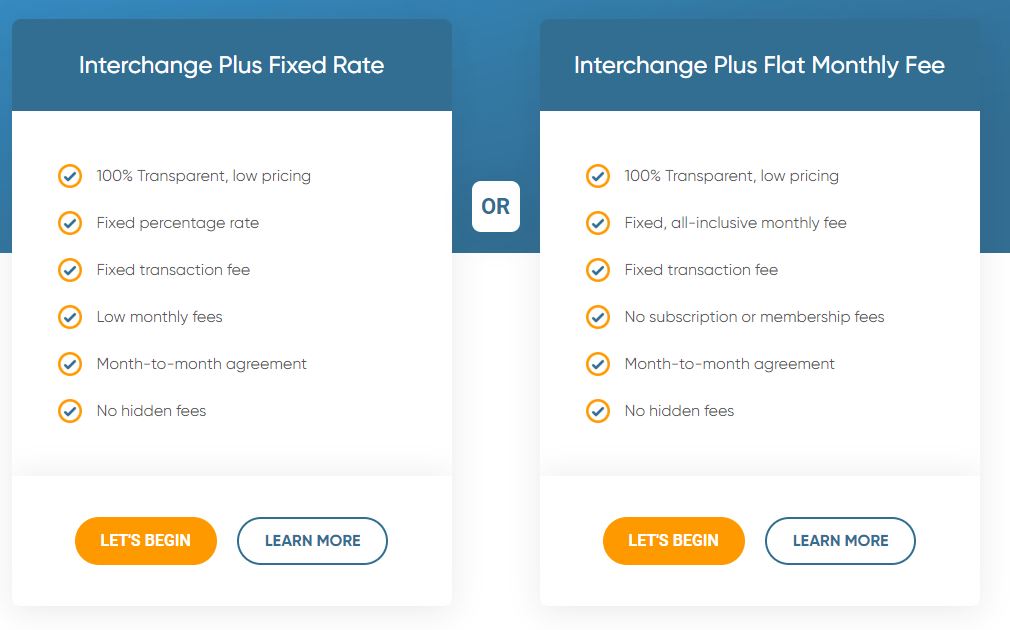

When it comes to pricing, ProMerchant offers two plans: Interchange Plus Fixed Rate and Interchange Plus Flat MOnthly Fee.

The month-to-month plan is a great deal as you can cancel anytime. Plus, you don’t get a per-transaction percentage fee like you’d get with the fixed rate plan.

7. Payment Depot

• Accepts all major credit cards

• Small membership fee

• Low processing fee

• No cancellation fee

• Compare quotes

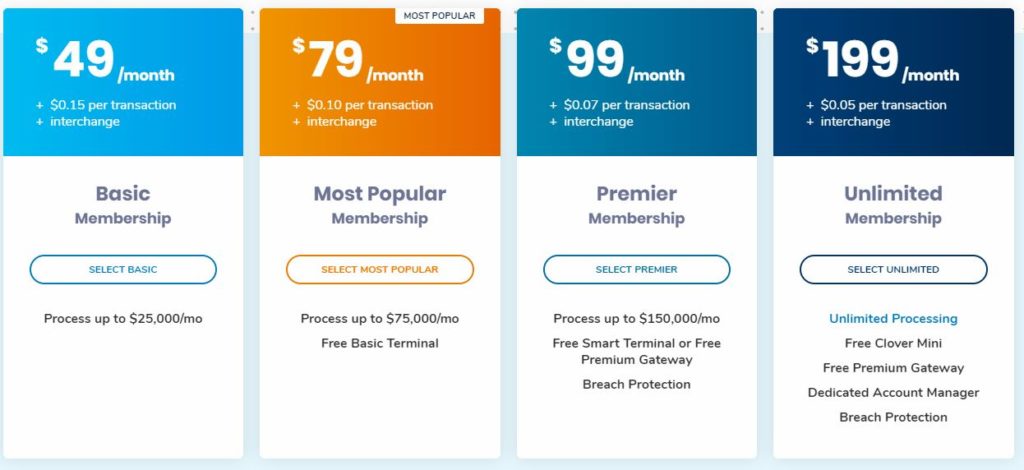

Payment Depot touts themselves as the “Costco of credit card processing” for their membership fee-based pricing model as well as their low processing fees. How low are they? They can get as low as $0.05 a month for an unlimited membership.

While the membership fees might seem like a lot of money each month, you’ll actually be saving money when it comes to the processing fees—which can add up over time. And the processing fees they do have aren’t percentage-based. Rather it’s a fixed fee between $0.05 – $0.15 per transaction. This makes Payment Depot a highly lucrative option if you’re a larger business that sees a ton of business each month. You’ll get significantly more savings that a traditional interchange + pricing

However, if you’re a smaller business, you might end up paying a bit more for the monthly membership fee. Still, its cheapest option can still be pretty lucrative if you earn enough money.

If you go with an annual membership, Payment Depot offers a 90-day money-back guarantee. That means you can cancel within three-ish months and send your equipment back, and you’ll get a complete refund.

8. Google Pay

Easy to integrate

Compatible with Shopify

Extremely easy to set up

Compare Quotes

Last, but certainly not least, on our list is another digital wallet offered by one of the most recognizable names in the world; Google.

Google Pay is made for ecommerce shops, mobile apps, and in-person checkouts.

Industry giants like Airbnb and StubHub have already added Google Pay to their checkout processes. After integrating the new Google Pay API to their site, StubHub saw a 600% increase in unique visitors buying with Google Pay.

Customers are slowly but surely starting to get more familiar with it.

Google Pay is very easy to integrate into your ecommerce platform. Just gain access to the API and add it your site. After you run some tests it will be good to go.

It’s also worth noting that Google Pay can be integrated with other payment methods that you might already be using on your site, like Shopify, as well as some of the other ones we’ve already covered on this list, like Stripe and Square.

Conclusion

Your ecommerce site is useless if you can’t get paid. It’s time for you to realize that all of your customers don’t have the same preferences.

You need to give them as many options as possible to increase your conversion rates.

Digital wallets are growing in popularity. It’s easier for customers to use these alternative payment methods as opposed to manually typing out their payment information. By reducing friction in your checkout process, you’ll be able to drive more sales and reduce shopping cart abandonment rates.

That’s why you should consider adding these payment methods to your ecommerce site. The more options you have, the better it will be for you in the long run.

Compare Quotes From The Best Credit Card Processing Services

Get matched up with a credit card processing service that fits your needs.

Compare Quotesfrom Quick Sprout https://ift.tt/2Z4ex2d

via IFTTT