Want to jump straight to the answer? The best invoice factoring company for most people is definitely BlueVine.

Unpaid invoices are part of running a business. It’s a frustrating and unfortunate reality for small business owners everywhere.

When invoices don’t get paid, it can put you in a bind where you’re shorter on cash than you’d like. And this only compounds with the more invoices for which you’re still waiting on payment.

If your business has unpaid invoices and you’re low on cash, you need to consider invoice factoring.

Compare Quotes From The Best Invoice Factoring Companies

Get matched up with an invoice factoring company that fits your needs.

The 7 Best Invoice Factoring Companies of 2021

Invoice factoring can be a confusing topic to most small business owners. And with so many different companies to choose from, finding the best option for your organization can feel a bit overwhelming.

Fortunately, I’ve already done all of the research for you.

- BlueVine – Fastest funding with low rates

- Paragon Financial – Best non-recourse invoice factoring

- altLINE – Best for low fees

- Triumph Business Capital – Best for trucking and freight companies

- Breakout Capital – Most flexible invoice factoring company

- TCI Business Capital – Best for month-to-month contracts

- Riviera Finance – Best for guaranteed credit

I’ll give you an in-depth review of each company as we continue through this guide. This will help you find the best choice for your needs.

Best Invoice Factoring Companies Reviews

#1 – BlueVine — Fastest Funding with Low Rates

- Rates start at .25% per week

- Factoring lines up to $5 million

- No long-term contracts

- Apply quickly online

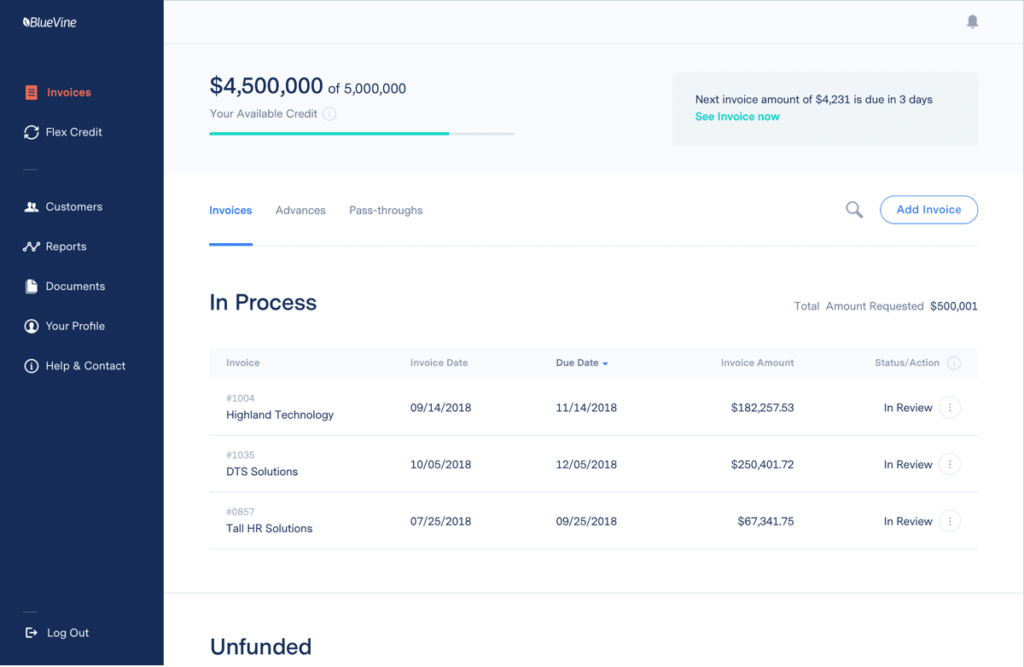

BlueVine is one of the most popular and reputable invoice factoring companies out there. That’s because of their high factoring lines, low rates, and commitment to speedy funding.

BlueVine offers factoring lines of up to $5 million. Factoring rates start at just 0.25% per week.

The approval process is fast. For businesses that need cash right away, you can get approved in just 24 hours.

The funding process is easy and flexible. You’ll have the opportunity to get higher credit limits based on the strength of your customers.

BlueVine’s fees are transparent, so you always know exactly how much the factoring will cost you. Instead of collecting recurring payments, they charge a weekly fee that’s due when the invoice gets paid.

You’ll have full control over what invoices get sold—only fund what you need without committing to a long-term contract.

Here’s how the process works:

It takes fewer than ten minutes to apply online. You provide a few basic details about your business, then the application approval process takes up to 24 hours.

Once approved, simply submit any unpaid invoices by syncing your accounting software or uploading them to your BlueVine dashboard.

BlueVine pays 85%-90% of the cash instantly. You’ll get the rest of the money, less the BlueVine fee, once the invoice gets paid.

These are the minimum qualifications to get started with invoice factoring from BlueVine:

- Must be in business for at least 3+ months

- Your business generates $10,000 in monthly revenue

- You have a B2B company (invoices from traditional consumers aren’t eligible)

- Personal FICO score of 530+

You’ll also need to provide BlueVine some basic details about your invoices and show three months of recent bank statements. Get started now at BlueVine.

#2 – Paragon Financial — Best Non-Recourse Invoice Factoring

- Non-recourse invoice factoring

- Purchase order financing

- In business 25+ years

- Great option for startups

Paragon Financial is a non-recourse invoice factoring company. That means if your customers fail to pay back your invoice, you’re not completely on the hook to pay back the factoring company for it.

This is the most ideal situation, because you can get funded without assuming the liability for unpaid invoices.

It’s a great option for startups, entrepreneurs, and businesses with tax issues. Paragon Financial typically works with lots of government contractors. Your personal credit won’t impact any approvals. Since Paragon assumes the risk, they make decisions based on the credit of your clients.

To qualify for invoice factoring with Paragon Financial, you’ll need a minimum of $30,000 in monthly sales. This is a bit higher compared to other options that we’ve reviewed.

In addition to invoice factoring, Paragon Financial also offers purchase order financing and working capital for government contracting. Get started at Paragon Financial.

#3 – altLINE — Best for Low Fees

- Very low fees

- Direct source of funding

- Delivers 90% of qualified invoices

- 100% transparent

>> Compare Quotes

altLINE is a reliable and trusted invoice factoring service that stands out for their low fees.

They’re especially unique because they’re a direct source of funding, not a middle man. As a division of the Southern Bank Company, altLINE doesn’t need to charge additional borrowing costs like third-party providers. Business owners can benefit from these savings because they won’t nickel-and-dime you with fees.

There’s also no application fee, which means you save even more money when using their service.

In addition to invoice factoring, altLINE offers accounts receivable financing. While the two terms are often used interchangeably in the world of small business lending, they are not the same.

Invoice factoring offers great flexibility for business owners. Accounts receivable financing has stricter guidelines related to the credit profile. With that said, AR financing will usually provide businesses with preferred financing terms.

altLINE will deliver up to 90% of qualified unpaid invoices for factoring.

Common industries for invoice factoring with altLINE include:

- Distribution

- Consulting

- Food and beverage

- Janitorial services

- Professional services

- Facility services

- Textile and apparel

- Wholesale

- Oil and gas

- Staffing

- Manufacturing

As a federally regulated bank, altLINE is 100% transparent about their fees and term structures. Factoring rates start at just 0.50%. You’ll also benefit from a fast approval process without an application fee.

In addition to invoice factoring and accounts receivable financing, altLINE also has asset-based lending for businesses. This is another way to borrow money against your receivables.

#4 – Triumph Business Capital — Best for Trucking and Freight Companies

- Preferred by trucking companies

- Easy-to-use web portal

- Great for freight and trucking

- Direct access to support

>> Compare Quotes

Triumph Business Capital is a factoring company that’s preferred by trucking and freight companies—and it’s no surprise why.

Freight companies love working with Triumph for invoice factoring because they understand the complexities of freight brokering, working capacity, and how cash flows throughout their businesses.

Triumph’s great service for trucking and freight companies led to them being awarded the Preferred Provider status by the Transportation Intermediaries Association.

It doesn’t matter if you’re a solo operation or if you have a fleet of hundreds of trucks—they provide you with a straightforward and speedy process to get money in your hands as soon as possible.

A few other services that they cater to include:

- Trucking

- Staffing

- Oil and gas

- Government contractors

- Freight brokers

Another standout feature is their easy-to-use web portal. The dashboard and process is a simple way to manage your funding. You can always stay up to date with your account and information, no matter where you are.

You’ll also have direct access to support from the Triumph Business Capital team. They also offer a wide range of financial services along with invoice factoring:

- Asset management

- Commuting banking

- Asset-based lending

- Equipment financing

- Insurance

Think of it as your financial one-stop shop.

#5 – Breakout Capital — Most Flexible Payments & Qualifications for Small Businesses

- Flexible qualifications

- Customized solutions

- Easy approval process

- Great for startups

>> Compare Quotes

Breakout Capital offers a very flexible invoice factoring solution that’s great for new and small businesses alike.

More specifically, they offer a very flexible payback schedule that gives small businesses more wiggle room when it comes to when they have to pay Breakout Capital back. These come in the form of daily, weekly, or monthly scheduling options. Not a lot of invoice factoring companies do this.

They also offer a great service called “FactorAdvantage.” It’s a customized solution for businesses that don’t meet qualifications from other lenders and factoring companies. That’s great for startups.

Think of it as a combination between invoice factoring and a small business loan.

Here are some of the top advantages of this service:

- Fund receivables before invoices are ready to factor

- Increase your over-advance maximum amounts

- Access to short-term bridge loans

- Remove merchant cash advance programs or liens

- Forecast cash flow with AI technology

Breakout Capital is perfect for startups since the approval process is dead simple. There’s no minimum FICO score required, no minimum monthly revenue requirement, and no minimum time in business.

With all of that said, Breakout Capital’s invoice factoring rates are a bit higher than some of the other companies we’ve reviewed. Invoice factoring starts at 1.25% per month.

For startups that want to borrow up to $500,000 using unpaid invoices, Breakout Capital is a top company for you to consider. FactorAdvantage is unlike any other product I’ve seen on the market today.

#6 – TCI Business Capital — Best for Month-to-Month Contracts

TCI Capital is great for businesses looking for flexible monthly contracts.

That’s because the amount they charge you changes month-to-month depending on the volume of your invoices. That means if you sell more and you have more invoices, you get cheaper factoring fees.

While some other companies do this too, TCI Capital stands out for doing this monthly as opposed to other companies that might only change your rates once a year.

B2B organizations that use TCI Capital for invoice factoring typically fall into one of the following categories:

- Staffing

- Telecom and wireless

- Heavy construction

- Renewable energy

- Government contractors

- Utility and pipeline contractors

- Trucking and freight

- Manufacturing

- Environmental services

- Oilfield services

TCI Capital adds a personal touch to their invoice factoring services. They encourage you to talk to a representative that will help you find the best solution for your current situation and needs. TCI Capital also ensures that the solution works well for your customers.

Like most companies, TCI Capital’s factoring fees are based on volume. So it’s a better option for those of you with higher volumes if you want access to preferred rates and fees.

The TCI Capital website has an awesome tool to help you calculate your factoring costs.

Choose your desired advance rate of 70%, 80%, or 90%, and enter your average monthly sales.

Select your customer payment terms (net 30, 60, 90, or 120), and the tool will automatically calculate your fees.

For example, let’s say you average $10,000 per month with net 60 terms on your invoices. If you want 90% of cash in advance, the factoring fee is $200.

With TCI Capital, you’ll get fast approvals, simple onboarding, and month-to-month terms. They offer high advances and same-day funding to provide you with reliable cash flow.

#7 – Riviera Finance — Best for Guaranteed Credit

- Guaranteed 24-hour funding

- Offers credit guarantee

- Online account dashboard

- Funding on demand

>> Compare Quotes

Riviera Finance is another great non-recourse invoice factoring service. Where they stand out though is their credit guarantee.

They offer a credit management service that guarantees the credit on all of your factored invoices. That means if an invoice is unpaid, Riviera Finance becomes the credit manager and assumes the risk.

They’re also great if you need cash quickly. Riviera offers some of the quickest turnaround rates in the industry, with guaranteed 24-hour funding.

Depending on your business type, industry, and clients, Riviera Finance will fund up to 95% of qualified invoices. You’ll have complete flexibility for funding on-demand.

As a result, no debt is created on your end and the company protects you from bad debt on all of the invoices that they factor.

Riviera Finance has an exceptional receivable management system as well. They can handle the following AR tasks:

- Maintain an efficient process with your clients

- Automated invoice uploads

- Mailing and processing for all invoices

- Processing and posting of invoice payments

- Real-time alerts related to returns, disputes, or payment issues

- Check the status of outstanding invoices

- Custom management reports

You’ll benefit from instant access 24/7 to all of your account receivable information through an online account dashboard.

How to Choose the Best Invoice Factoring Company For Your Business

Invoice factoring can be incredibly lucrative for your business. By giving you money quickly, you’ll be able to reinvest your income and grow even more.

But it’s important that you find the right invoice factoring company to meet the needs of your business.

There are certain factors that you should look for when you’re evaluating an invoice factoring service. This is our methodology for narrowing down your options.

Compare Quotes From The Best Invoice Factoring Companies

Get matched up with an invoice factoring company that fits your needs.

Fast Funding

A good invoice factoring service gets cash back in your pocket quickly and painlessly. The best services provide quick approvals and turnarounds.

Many invoice factoring companies such as BlueVine boast approvals “as fast as 5 minutes” upon receiving a qualified invoice.

Other factoring services such as altLine take a little bit longer—around four days to complete. That can be a looonng time.

Depending on where you are with your company, you might want money quicker in order to address short-term needs or lucrative investment opportunities.

You also want to check with the factoring company and see how long it takes funds to be available. Ideally, it’ll be within a day of approval but can take up to three days.

Remember: You’re factoring because you want cash quickly. So be sure to check to see how long the approval and funding process takes with each factoring service.

Industry-Specific Factoring

Some invoice factoring companies specialize in specific industries. These can be lucrative as they know the proper procedures to obtain payment from your unpaid invoices.

These factoring companies understand your industry and business. They’ll help the factoring experience go as smoothly and optimally as possible because of that.

For example, Triumph Business Capital helps small and mid-sized businesses in transportation (e.g. trucking and freight brokers), energy (e.g. oil and gas), and government (e.g. contractors).

TCI Capital is another great factoring company that focuses on B2B organizations such as telecom, manufacturing, utility, and staffing.

Look for a factoring company that knows your industry. That way you can help ensure the best experience.

Factoring Fees

A lot of business owners see the short-term benefits of invoice factoring (i.e. upfront cash). But they overlook the fees that this will cost.

Some invoice factoring companies lure you in with low factoring fees, but then hit you with additional fees like:

- Application fee

- Service fee

- Renewals

- Transfers

- Early termination

- Origination fee

I’d recommend an invoice factoring company that offers transparent pricing. You should only have to pay the factoring fee, without any of these additional charges or hidden fees.

Recourse vs Non-Recourse Factoring

What happens if one of your customers fails to pay an invoice to the factoring company? Depending on the company you choose, you could be responsible for this debt.

That’s because invoice factoring comes in two forms:

- Recourse factoring means that if your client doesn’t pay on their invoice to the factoring company, then you are on the hook financially for the invoice. The trade off is the fees are much lower.

- Non-Recourse factoring means that the factoring company assumes some of the risk. The fees are higher, but you’re at less of a risk of losing out on all of your unpaid invoice. This is a better option for businesses who can’t risk a client withholding payment.

No matter what, you want to make sure that the invoice factoring company you choose does everything that they can to try and attain payment from your client. You don’t want them sitting on the invoice, making no attempt to reach out, and then ding you when your client doesn’t pay.

When researching companies, see what steps they’ll take to collect. Make sure it’s polite (you don’t want your customer to hate you, after all) but also firm.

Factoring Flexibility

Flexibility on the requirements and types of invoicing is great when it comes to these companies. As such, you’ll want to find a factoring company that doesn’t try to lock you into a strict contract while also giving you the credit you need.

Some of you may only want to factor one or two invoices. Doing this on-demand is known as “spot factoring.”

You’ll have complete control over which invoices are factored and when it happens. You’ll also have more of a say in your term length—which is always nice.

Some invoice factoring companies require “whole ledger factoring.” In this case, you won’t have as much control. Generally speaking, spot factoring is the preferred choice for business owners.

Also you’ll want to keep an eye out on the types of credit lines these factoring companies offer as well.

A place like BlueVine will give you credit for up to $5 million, and they’ll also work with you if you have a low credit score (530 FICO minimum) and have just been in business for 3 months.

Conclusion

Invoice factoring is generally reserved for B2B organizations. But there are still plenty of different niches and unique circumstances within that category. This list has an option for everyone.

Compare Quotes From The Best Invoice Factoring Companies

Get matched up with an invoice factoring company that fits your needs.

from Quick Sprout https://ift.tt/3bnBiD0

via IFTTT