Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

Every business needs insurance. Depending on your business type and industry, some of you will need more protection than others.

Without insurance, you could be liable for potentially hundreds of thousands or even millions of dollars.

What happens if one of your vehicles is involved in an accident? How will you pay for the damages of a fire or flood in your office? What if an employee or customer slips and falls on your property?

You need to have insurance, or you’ll be paying these costs out of pocket.

But finding the best business insurance package for your organization can be tricky. On the one hand, you want to make sure that you’re covered, but on the other, you don’t want to overpay on premiums.

The best way to start your search is by choosing a reputable business insurance provider—I’ve narrowed down the top business insurance companies in this guide.

The Top 6 Options For Business Insurance

How to Choose the Best Business Insurance For You

There is no “one-size-fits-all” plan for business insurance. Every organization is unique, so you’ll need custom protection based on your needs. Certain insurance providers are definitely better for specific types of insurance, as well as other factors.

As you’re browsing and getting quotes from different providers, make sure you keep the following considerations in mind:

Industry

Some insurance providers have more experience covering businesses within certain industries.

For example, a restaurant would have very different insurance needs from a construction company. A dental practice won’t have the same needs as an ecommerce website. You get the idea.

So as you’re evaluating a potential provider, take a look at their existing clients and industries served. Do they have experience covering businesses in your industry? If not, look elsewhere.

Customer Service

If you have to submit a claim, you want to make sure that your insurance provider has your back. When you pick up the phone, will someone answer?

Any delay in the claims process will cost your business money. Let’s say there is a flood at your retail storefront. If your insurance company drags their feet, you might not be able to re-open. How soon will someone come to evaluate the property? How quickly can they approve a contractor to repair the damages?

Choose an insurance company that will go the extra mile to serve your business in times when you need their help the most—that’s what you’re paying them for.

Reputation of Provider

There are literally thousands of insurance companies in the United States. Some are brand new, some have been around since the inception of insurance, and many fall somewhere in between.

In most cases, I prefer to go with an older insurance company with a long-standing reputation. These providers have seen it all, and they’ve survived the test of time. You run some risk if you go with a newer company. Let’s say you have some obscure or rare situation with a claim. It could be a first for a new company, and they might not know how to handle it.

Coverage Options

We’ll talk about the different types of business insurance in greater detail shortly. But in a perfect world, you’d like to get all of your business insurance coverage under one roof.

Getting property insurance from one provider, vehicle insurance from another, and general liability from a third company is just too confusing. So look for an insurance company that has a wide array of coverage options that accommodate your needs.

Premiums

Getting proper coverage is obviously important, but how much is this going to cost you?

If you choose the cheapest plan you can find, you’ll probably be exposed to some more out of pocket costs. But if you choose the most expensive plan on the market, do you actually need all of that coverage?

Look for a balance between these two extremes. When it comes to insurance, I typically like to be a bit more conservative. I’d rather overpay a little bit than risk not being fully covered. But this all depends on your individual risk tolerance.

The Different Types of Business Insurance

There are dozens of different business insurance types. But for the purposes of this guide, I’m going to focus on the ones that are the most common and applicable to the masses.

General Liability Insurance

General liability coverage protects you from risks like bodily injuries and property damage. This typically includes medical payments if someone is hurt on your company’s property. General liability can also protect you from lawsuits related to things like libel, slander, privacy violations, copyright infringement, wrongful evictions, and more.

Most businesses will need some type of general liability coverage.

Professional Liability Insurance

Professional liability and general liability are often confused with each other, although the two are not one in the same.

Professional liability insurance is also referred to as errors and omissions (E&O) insurance. This protects businesses sued by clients claiming damages for professional services that you provide. Things like an accountant making a mistake on a tax return or a web developer making mistakes on a site that they manage would be examples where professional liability insurance is necessary.

BOP Insurance

Business owners insurance (better known as BOP) is a policy that combines liability and property into one package. It’s very common for small and mid-sized business owners across a wide range of industries. Most contractors will carry some form of BOP insurance as well.

BOP packages do not cover your employees—it’s specific to business owners.

Workers’ Compensation Insurance

Once you hire your first employee, workers’ compensation should be immediately added to your business insurance policy. Most states require workers’ comp insurance by law.

The coverage pays for things like medical expenses and disability for employees who were injured on the job. This could include minor slip and fall injuries to long-term conditions (like carpal tunnel) or even death.

Business Interruption Insurance

This type of insurance will protect your company if your operations are interrupted during some type of disaster or catastrophic event. Organizations with physical locations that could lose income due to these types of interruptions can benefit from a business interruption policy.

Your business can be compensated for lost income in these types of scenarios.

Vehicle Insurance

This type of business insurance policy is pretty-self explanatory. Just like you need insurance for your personal vehicle, you’ll need to cover any vehicles used for business purposes. If an accident occurs with one of your vehicles (whether you’re driving or not), you’ll need this type of coverage.

Property Insurance

Whether you own or lease physical space, you need to have property insurance. Again, it’s similar to the type of insurance you’d have to protect your home or apartment.

This type of insurance will protect your business from events like fires or theft. Your equipment, inventory, furniture, etc. should all be covered in this policy. However, it’s worth noting that some types of natural disasters, like earthquakes, aren’t always covered in a standard property insurance policy. You might have to pay extra for this type of coverage, depending on your area and the insurance provider.

Product Liability Insurance

If your company manufactures products that are sold to the general public, you must have product liability insurance. This coverage will protect your company from lawsuits related to damages caused by your products.

For example, if someone is injured using one of your products, they could sue your company directly for their medical expenses. That’s when product liability insurance would kick in.

#1 – Chubb Review — Most Versatile Business Insurance Packages

Chubb is one of the most reputable business insurance providers on the market today. They are known for exceptional customer service.

This provider has a wide range of plans for small businesses, commercial insurance, industry-specific policies, and more.

Compared to other insurance providers on the market, Chubb has one of the most extensive coverage portfolios that you can find. Some examples of these policy categories include:

- Accident and health

- General liability

- Cyber insurance

- Environmental packages (premises pollution liability and contractor pollution liability)

- International insurance packages

- Management liability

- Inland and ocean marine

- Product recall liability

- Professional liability

- Workers’ compensation

Chubb has over 200 years of experience in the business insurance space. Just be aware that their premiums tend to be a bit higher than other options—but you’re paying for the best.

#2 – CNA Review — The Best Custom Business Insurance Plans

CNA is another reputable provider in the business insurance world. They have 120+ years of expertise in this field.

With CNA, you’ll benefit from a custom insurance package to help manage your risks and liabilities.

There are certain industries that CNA has the most experience working with; these include construction, education, manufacturing, healthcare, real estate, wholesale, technology, professional services, finance, and more.

Here’s a quick glance at some of the types of business insurance offered by CNA:

- Workers’ compensation insurance

- Professional liability insurance (errors and omissions)

- Property insurance

- Commercial auto insurance

- Business interruption insurance

- General liability insurance

- Equipment breakdown insurance

I like CNA because you can pick and choose which types of coverage you need, and get them bundled into a single policy that’s custom fit to your needs.

#3 – Hiscox Review — Best For Small Business Insurance

Hiscox is my top recommendation for small business owners. Their policies are affordable, while still providing you with enough coverage to protect your organization from a wide range of potential scenarios.

When I say that Hiscox is great for small businesses, I mean ALL small businesses. They’re currently providing protection to organizations in 180+ different industries.

The list of coverage types offered by Hiscox isn’t quite as extensive as some of the other options on the market today. But they still have more than enough options to accommodate the needs of most businesses.

- General liability insurance for small business

- Professional liability (E&O) insurance for small business

- Business owners policy (BOP) for small business

- Short-term liability insurance for small business

- Cyber insurance for small business

- Workers’ comp for small business

- Commercial auto insurance for small business

- Umbrella insurance for small business

- Employment practices liability insurance for small business

Hiscox is an established name in the business insurance world. They’ve been around since 1901 and insure 300,000+ small businesses across the US.

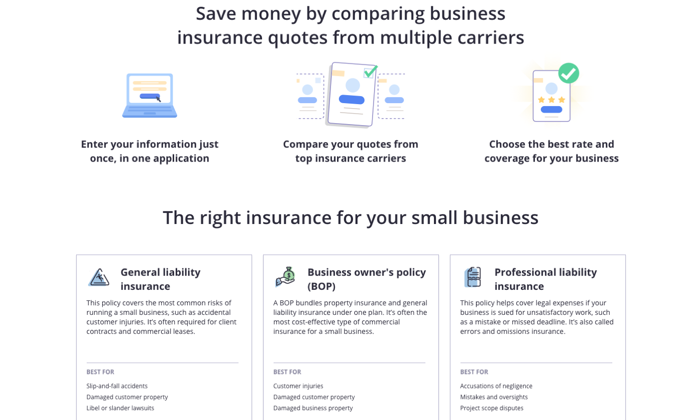

#4 – Insureon Review — Best Business Insurance Marketplace

Technically speaking, Insureon isn’t actually an insurance provider; it’s an online marketplace for business insurance.

But this robust platform definitely deserves a spot on my list. Insureon is super easy to use, and it’s the best way to compare coverage options from different providers in a single place.

If you’re looking to get the best possible rate, I strongly recommend Insureon. Otherwise, you’d have to get quotes from different providers individually, which is much more of a hassle.

Insureon allows you to compare free quotes from some of the top-rated and well-known business insurance providers on the market today (including some of the options on our list).

- Travelers

- Chubb

- Hiscox

- Hannover

- The Hartford

- Liberty Mutual

- AmTrust Financial

The list goes on and on. You can browse policies for professional liability insurance, cyber liability insurance, BOP policies, general liability insurance, commercial property insurance, workers’ compensation insurance, and more.

Insureon is typically geared toward smaller businesses. But it’s used across a wide range of different industries.

#5 – Progressive Review — The Best For Commercial Auto Insurance

Progressive is an industry leader in the commercial auto coverage space.

With 45+ years of experience, they aren’t quite as old as some other players in the industry. However, Progressive is definitely a well-established and trustworthy provider for commercial auto policies.

Here’s a list of some common types of business vehicles insured by Progressive:

- Buses

- Limousines

- Trucks

- Vans

- Landscaping vehicles

- Tow trucks

- Box trucks

- Snow plows

- Sports utility vehicles (for hauling cargo and transporting products)

- Pickup trucks

- Trailers

It’s worth noting that there are certain types of vehicles that Progressive will NOT insure. This includes emergency vehicles (like fire trucks and ambulances), golf carts, double-decker buses, monster trucks, race cars, wheelchair buses, and a few others.

In addition to the commercial policies, Progressive also has coverage for general liability, BOP, professional liability, workers’ comp, and more.

#6 – The Hartford Review — The Best For Workers’ Comp

For those of you who don’t know, Hartford, Connecticut is known as the “insurance capital of the world.” So it’s no surprise to see The Hartford (named for its headquarters’ namesake) on our list.

This company was founded more than two centuries ago, back in 1810. To say they are a well-established name in the business insurance industry would be a drastic understatement.

The Hartford has an extensive list of product offerings for business insurance. Some of their most popular policies include:

- Business owners’ policy (BOP) insurance

- General liability insurance

- Workers’ compensation insurance

- Business income insurance

- Commercial auto insurance

- Commercial property insurance

- Commercial flood insurance

- Home-based business insurance

- Professional liability insurance

- Multinational business insurance

Overall, the workers’ comp coverages provided by The Hartford are second to none. If you want to give your employees the very best protection, look no further than The Hartford.

Summary

In a market saturated with business insurance options, there are really only six choices that I’d consider.

If you choose one of the names reviewed above, you can rest easy knowing that your business is being protected from a well-established and reputable provider.

Be sure to use the methodology I described earlier as you’re shopping around and evaluating different options. That’s the only way to get the best possible business insurance policy for your company.

The post Best Business Insurance appeared first on Neil Patel.

from Blog – Neil Patel https://ift.tt/33HMrME

via IFTTT