Starting a limited liability company in Montana offers tax advantages and liability protection to business owners.

But before you can get these benefits, you need to follow a strict procedure to legally form your LLC in the state of Montana.

Lots of new entrepreneurs are intimidated by the paperwork, filings, taxes, compliance, and registration process.

Fortunately, starting an LLC in Montana is easy.

This guide will teach you how to form your Montana LLC in just five simple steps.

The Easy Parts of Starting an LLC in Montana

To legally form your LLC in Montana, you need to file formation paperwork with the secretary of state’s office. But any errors on these documents can delay the process and potentially cause you to lose out on non-refundable application fees.

Rather than going through this process alone, using an online LLC formation service makes everything easier.

LegalZoom has been used to form over two million businesses nationwide. It’s definitely the simplest way to start an LLC in Montana.

Just answer some basic questions about yourself and the business—LegalZoom will handle everything else. They’ll create your articles of organization and file all of the appropriate paperwork with the Montana secretary of state office.

Beyond the basic formation options, LegalZoom also offers everything else you need to start an LLC in Montana. I’m referring to things like registered agent services, business name reservations, DBA names, operating agreements, EINs, business licenses, permits, and more.

You can get all of your needs fulfilled under one roof, which helps you get up and running as fast as possible, without having to worry about the administrative work.

Montana LLC formation plans from LegalZoom start at just $79 plus state filing fees.

The Difficult Parts of Starting an LLC in Montana

While the formation process itself is relatively easy, don’t expect everything to be smooth sailing.

Running a business is tough. This holds true whether you’re a first-time entrepreneur or an experienced business owner. Regardless of your business type or industry, starting from zero is really intimidating.

Some of you might owe money to lenders to cover your startup costs. Between paying interest on loans, hiring and managing employees, attracting new customers, and remaining compliant with the state, there’s going to be a lot on your plate.

I’m not saying this stuff to discourage you. I just want you to be realistic and prepare for some potentially tough times. It takes some businesses years to become cash-flow positive. But the end result is worth it if you can stick with your business plan and scale.

You’ll also need to remain in good standing with the state while you’re operating. Things like obtaining and renewing permits, filing annual reports, and fulfilling your tax obligations all fall into this category.

Step 1 – Name Your Montana LLC

Starting an LLC in Montana all begins with choosing a name. The name will be on all of your official formation paperwork, so you can’t really proceed without one.

Some of you might already have a name in mind. But you’ll still need to follow the steps below to ensure you can legally register that name with the state.

Montana LLC Name Requirements

According to Montana state law, all LLCs must contain one of the following words or abbreviations in the name:

- Limited Liability Company

- Limited Company

- LLC

- LLC.

- L.L.C.

- LC

Names must be uniquely distinguishable from other business entities that have been registered with the Montana secretary of state office.

There are also some restricted words and phrases that can’t be used. For example, your Montana LLC name can’t imply a relationship to a government agency, like the treasury office, FBI, state department, etc.

Certain words like “bank” or “attorney” may require additional paperwork. These names are typically used for licensed professionals and can’t be included in the name of just any business.

Check the Name’s Availability

Once you’ve landed on a name that meets the requirements above, you need to make sure that it’s not already on file with the state.

You can do this manually on the Montana secretary of state website. But this isn’t the most user-friendly database on the web.

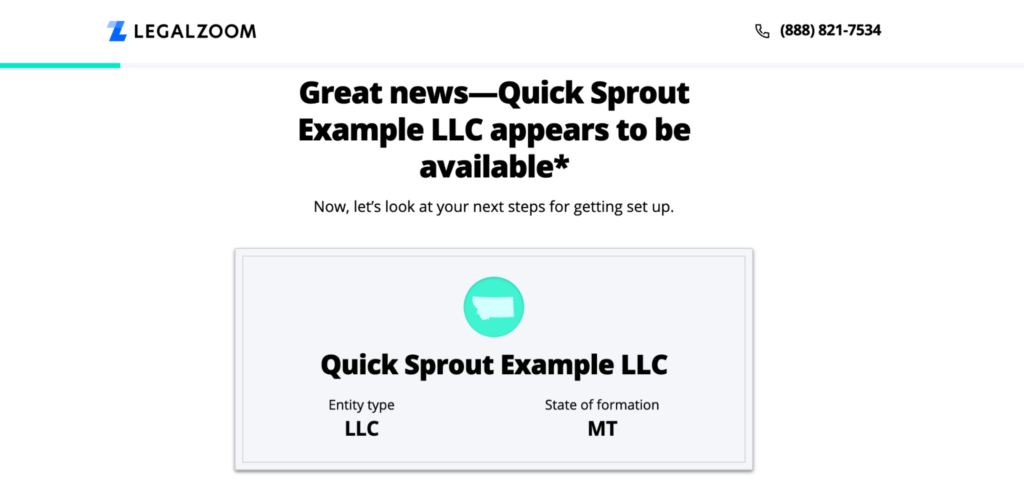

If you’re using LegalZoom to form your LLC in Montana, they’ll verify the name’s availability for you.

In addition to checking your name’s availability with the secretary of state database, there are several other resources you should check:

- Federal trademarks

- Domain name availability

- Social media handles

- Web search

Let’s pretend the name you want is available to register with the state.

That name may not be ideal if you can’t secure the domain or social media profiles. If someone else has a federal trademark on that name, it can really hurt your expansion capabilities. Running a web search can help you identify potential conflicts or bad publicity with the name. So always do your due diligence before you file any official paperwork.

Reserve Your Name With the Montana Secretary of State

If your name meets all of the criteria mentioned above, you’ll want to secure it ASAP. The fastest way to secure it is by filing your articles of organization (we’ll get to that step shortly).

But if you’re not quite ready to form the business today, you can reserve the name by filing a Reservation of Name form with the state. There’s a $10 filing fee, and you can do this online fairly quickly.

This name reservation form can prevent another business in the state from filing that name for up to 120 days. So you’ll have some time to file your articles of organization.

If you don’t already have one, you’ll need to create an ePass Montana account to fill out and file the form online.

Register an Assumed Business Name

This is another optional step when it comes to naming your Montana LLC. Just head to the Montana secretary of state website and click on the Registration of Assumed Business Name (ABN/DBA) form.

While the legal name of your business on the articles of organization will be used to identify your business with the state, a DBA (“doing business as”) name can be used in the real world for business purposes.

For example, the legal name of your LLC might be “Matthew Mechanical Limited Liability Company,” but the assumed name could be “Matt’s Auto Shop.”

Title 30 Chapter 13 of the Montana legal code covers everything you need to know about registering an assumed name in Montana.

Step 2 – Designate a Registered Agent

All LLCs in Montana must appoint a registered agent during the formation process. A registered agent will be responsible for receiving government correspondence and service of process on behalf of your company.

Technically, you could be your own registered agent in Montana. But I advise against that.

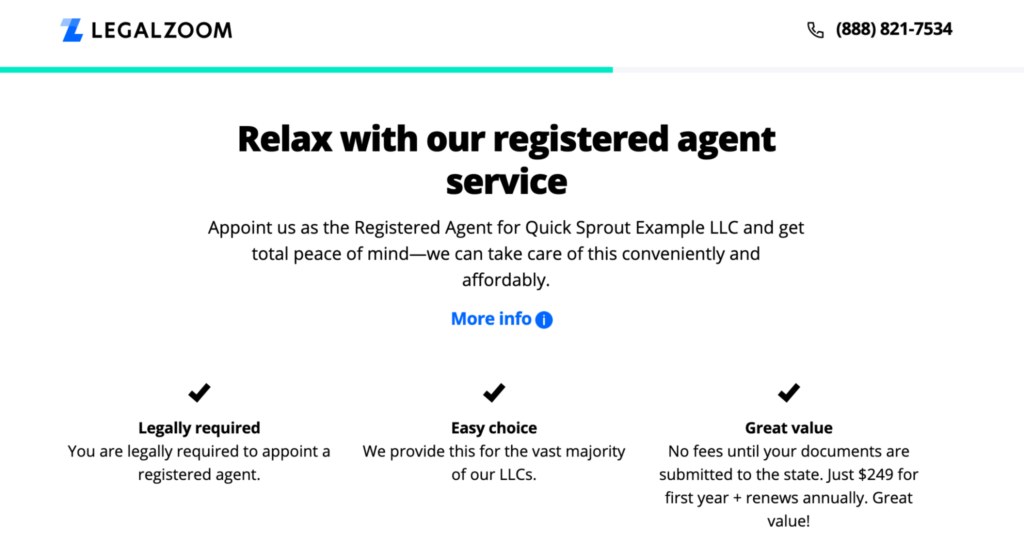

If you’re using LegalZoom to form your Montana LLC, you’ll have the option to appoint them as the registered agent while you’re setting up the account.

The service starts at $249 per year and renews automatically. This rate is actually a bit high compared to other registered agent services on the market, but don’t let that deter you from using it.

LegalZoom will alert you whenever they receive important documents on your behalf. You’ll also get messages about tax deadlines and other compliance-related deadlines that you need to handle.

Montana Registered Agent Requirements

LegalZoom fulfills the requirements of a registered agent in Montana. But if you’re planning to use another option, just make sure it hits the following guidelines:

- Must be available in-person to accept service of process on behalf of the business.

- Must have a physical office address within the state (no PO boxes allowed).

- Must be a Montana resident or be a business allowed to provide registered agent services in the state.

Again, just appointing LegalZoom as your registered agent during the formation process will make your life easier. You won’t have to worry about this.

Step 3 – File Your LLC Formation Documents

Now that you have everything lined up, you can proceed with the paperwork required to form your LLC in Montana.

Articles of Organization

The articles of organization is the primary document used to register your business with the secretary of state. Information required on this document includes:

- LLC name

- Type of LLC (regular, professional, series)

- Registered agent name and address

- LLC principal office address

- Perpetual term or formed for a specific time period

- Purpose of the LLC

- Whether or not it’s a tribal business

- Whether it’s member-managed or manager-managed

- Names and addresses of members and managers

- List of liable members with the debts and obligations along with written consents of each one

The document must be signed by the applicant, and it can be filed online with the secretary of state.

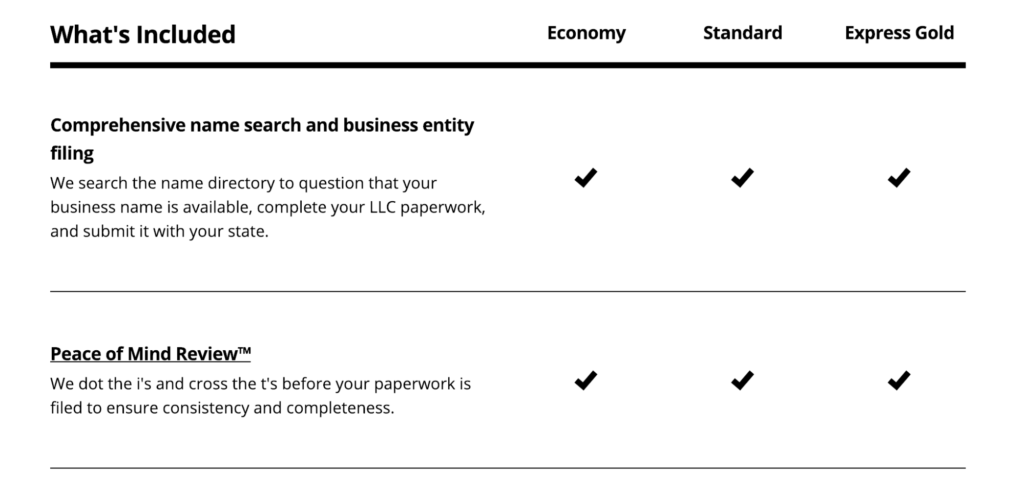

Rather than filling out this information and filing on your own, LegalZoom can do it on your behalf. This service is included with every LLC formation plan.

Certificate of Authority of Foreign Limited Liability Corporation (Foreign LLCs Only)

LLCs formed outside of Montana that wish to do business in the state must register as a foreign LLC with the secretary of state. If the name of your business in another state isn’t available in Montana, then you’ll be required to register an assumed name.

The paperwork required for this type of LLC is a bit different. You’ll need to file an Authority of Foreign Limited Liability Corporation along with a certificate of good standing or a certificate of existence in the original state of formation.

Step 4 – Draft an Operating Agreement

An operating agreement doesn’t get filed with the state. However, it’s an important document to create during the formation process. This is especially true if you’re starting a multi-member LLC.

It defines the rules for how you’ll manage the business. The document includes member voting rights, rules for adding new members, and explains how you’ll manage conflicts within the organization.

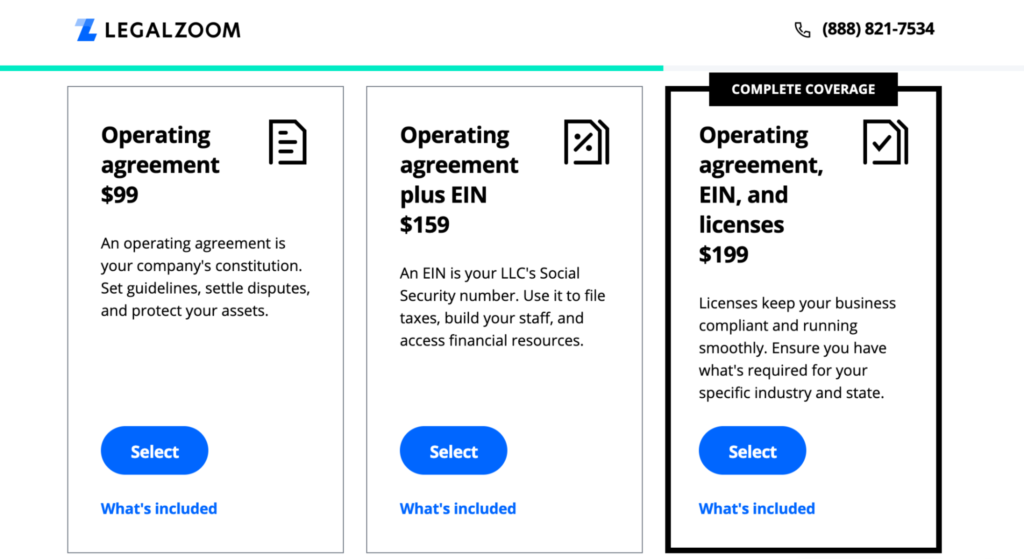

You can add an operating agreement to your LegalZoom package for just $99.

It’s definitely in your best interest to put all of these rules in writing ASAP. So don’t put this off as something you’ll get to later. Handle it immediately after filing your formation documents with the state.

Step 5 – Fulfill Legal Obligations For Montana LLCs

Once you’ve officially registered your LLC in Montana, there are still a few additional tasks you need to complete. These extra steps will ensure you’re compliant and legally allowed to operate in the state of Montana.

Obtain an EIN

An employer identification number, better known as an EIN, is required for taxation purposes at the federal and state level. You can get this directly from the IRS or just ask LegalZoom to obtain one for you during the formation process.

You can bundle it with your operating agreement and business licenses to get the best possible value.

Failing to get an EIN as soon as possible can prevent your business from moving forward. For example, you likely won’t be able to open a business bank account with your EIN.

Register with the Montana Department of Revenue

LLCs in Montana also need to register with the Montana Department of Revenue.

This is how you’ll fulfill different tax obligations with the state. For example, there are rules to follow if you have employees and some retail goods are subject to sales tax.

Head to the Montana TransAction Portal to register online and get your state tax compliance in order.

File Annual Reports

Montana LLCs must file an annual report by April 15th every year. This helps ensure your good standing with the state.

There’s a $20 filing fee, and late filings are subject to a $35 fine.

Failing to file can result in serious consequences. If your LLC was formed in Montana and you don’t file by December 1st, the LLC will be dissolved. Foreign LLCs that don’t file by November 1st won’t be allowed to do business in the state.

Get Montana Business Licenses and Permits

Last but certainly not least, you need to acquire any applicable state licenses, permits, or certifications.

The exact permits required will depend on your business type, industry, and location. For example, you might need to obtain a permit in some towns and counties but not others.

The Montana Governor’s Office of Economic Development has a business checklist that you can use to learn more about the permits and licenses required in your specific location. You can also use LegalZoom to assist you with this process.

from Quick Sprout https://ift.tt/3AxwA2d

via IFTTT