Want to jump straight to the answer? The best PEO service provider for most people is CoAdvantage or Oasis Advantage.

Outsourcing payroll or using software to manage HR isn’t always enough to take administrative tasks off your plate. That’s where PEO (professional employer organization) service providers come in.

Whether you’re interested in hiring a PEO service for the first time or looking to switch providers, we’ve reviewed the top PEO options out there.

Compare the Best PEO Companies

9 Best PEO Service Providers

- CoAdvantage

- Oasis Advantage

- Amplify PEO

- Insperity

- Paychex

- ADP TotalSource

- Justworks

- VensureHR

- TriNet

Read about each of the best PEO providers in this post. I’ll cover the features, benefits, and costs, as well as any drawbacks.

After the reviews, you’ll find a short guide to help you ask the right questions as you search for the best PEO service for your specific workplace.

Compare the Best PEO Companies

There are 957 PEO companies in the USA! Find out which one is the best match for your specific needs. Enter your zip code below to begin.

CoAdvantage PEO

- Full-Service PEO Solution

- Custom HR software

- Excellent Insurance Options

- Our Highest Rated PEO in Industry

In business for more than 30 years and working with businesses of all types in all 50 U.S. states, CoAdvantage PEO is one of the best PEO companies in the industry. It has the experience to take on practically any challenge your business might face.

CoAdvantage currently serves 90,000+ employees and works with more than 4,500 clients. This growth isn’t slowing down, either.

You’ll have a dedicated team of experienced professionals on your side from the moment you sign up. They can offer guidance on any HR issue to keep your business running smoothly and protected from risk.

By going with CoAdvantage, you’ll be able to focus on your business because all of the back-office concerns are off your plate.

CoAdvantage is a full-service PEO providing all the services you might expect. Specific service categories include but are not limited to:

- Payroll Management Services

- Benefits Administration

- Workers Compensation Insurance Plans

- Best-in-Industry HR Software

- Risk Management and Regulation Compliance

- HR Administration

- Recruitment and Teambuilding Services

- Top-Notch Customer Service

What makes CoAdvantage PEO stand out in my eyes is the great insurance savings you will get combined with best-in-class HR software.

Onboarding is easy and, for the most part, will not disturb operations while it is going on. It will be seamless, and any issues will be quickly resolved.

If you want to build your team and keep the best talent in your area (or even outside of it) in your company, then I recommend CoAdvantage PEO.

The price your company will get will depend on multiple factors like size of company, location, and current insurance, but you can easily contact them to get a quote.

Oasis Advantage

- Owned by Paychex

- Great service for startups

- 90-day money-back guarantee

- Originally founded in 1996

Oasis Advantage offers a fairly comprehensive line of PEO services that includes multiple touchpoints with your company. You’ll have both an HR generalist as well as a payroll accountant assigned to your account.

This “hands on” and service-focused approach has won Oasis Advantage many clients over the years. And, now that it is a Paychex company, Oasis is able to draw on massive national resources in order to serve your company better.

PEO services provided by Oasis Advantage include:

- Human resources

- Employee benefits

- Risk management

- Payroll

- Technology solutions

Oasis gives you the tools you need to invest in your workforce, from hiring to retirement. You’ll get a clear view of your company’s health, and support from HR professionals whenever a complex situation arises.

Oasis can help your small business get great deals on healthcare by bundling your plan with other clients. They’ll help you set up employee retirement plans as well.

Like other providers on our list, Oasis has some industry-specific solutions.

- Banking

- Architecture

- Hotels

- Education

- Restaurants

- Retail

- Private equity

- Legal

- Property management

- Financial services

I recommend Oasis to startup companies because it is versatile. Oasis is smaller than the other options on this list — but that only means it can give startups the special attention that they need.

While some PEO providers allow for month-to-month commitments, Oasis requires a one-year contract. So for those of you who don’t want to get locked in, this won’t be the best option for you.

With that said, Oasis Advanrage does offer a 90-day money-back guarantee window. So you’ll have some time to change your mind if you’re not satisfied in the first few months.

Amplify PEO

- Full-service PEO solutions

- Save money each year

- Cloud-based platform

- 24/7 HR Portal

Amplify offers a full-service PEO solution along with a suite of HR technology that centralizes information for admins and employees.

From hiring to retiring, all employee documents and data stay can stay in one place. Amplify offers any type of administrative relief you need: from GL mapping to complex compliance issues, they have a specialist ready to help.

And once your company is set up on Amplify, it’s easier to see the big picture. With expert guidance, Amplify will help you make smarter decisions about how to increase your revenue, lower costs, and offer your employees even better benefits.

They offer a roster of features and services you’d expect from the best HR solutions out there including:

- Payroll solutions

- Benefits options

- HR management

- Onboarding

- Compliance

- Time and labor

- Risk management

Amplify’s services help save companies an average of $1,185 per employee each year. Think about that. If your company has 25 employees, that’s nearly $30,000 a year saved. If your company has 100 employees, that’s $118,500 saved.

I really like Amplify because they’re more human than a lot of other PEO providers. And I mean that literally. Any and all HR issues are directed to an actual person rather than an automated call center.

So whether you’re looking for benefits solutions, payroll solutions, or retirement solutions, Amplify has you covered.

Pricing is obscured on their website, but you can request a quote for free.

Insperity

- Full-service HR solution

- Customized pricing

- Pick from individual services

- Excellent customer service

Insperity has been around for 30+ years. It provides full HR solutions for small businesses as well as enterprises with up to 5,000 employees.

Since being founded in 1986, Insperity has racked up a long list of awards, accreditations, achievements, and glowing reviews from their customers.

Insperity’s full-service HR solution includes:

- Employee benefits

- HR administration

- Payroll

- Risk management

- Compliance

- Talent management

- Tech services

And don’t worry if you don’t need a full-service solution. Their individual solutions are also great.

While Insperity can easily manage the needs of businesses with 150-5,000 employees, I’d recommend their services to small and medium-sized business owners with less than 150 employees.

You’ll also have access to the iOS and Android mobile apps to monitor and manage your business on the go. It’s a great option for those of you who enjoy leveraging the latest technology to streamline processes.

Although the company is big, they still provide excellent customer service and know how to work with small business owners.

Another top feature of Insperity is its flexibility. Unlike other PEO providers on the market, Insperity won’t lock you into a long-term contract. You can cancel at any time, as long as you give them 30 day’s notice.

Insperity does not list prices for their services online. You’ll need to speak with their customer service sales team to get a custom quote.

A potential drawback of using Insperity for PEO services is that their health plan options are limited. Unlike other providers, Insperity only offers health plans from a single health insurance provider.

So if your company wants to give your employees multiple options for healthcare, you should look elsewhere on my list. But this usually isn’t a problem for small business owners.

Paychex

- Full service or individual plans

- Pricing based on # of employees

- Dedicated HR manager support

- Used by 670,000+ companies

While Paychex is best known for its online payroll services, they are also a full-service PEO provider.

One of the biggest standouts of Paychex is the way that they provide PEO services. Every business that works with Paychex gets a dedicated HR professional. When you call for help, you’ll be speaking with someone who knows your business.

In some cases, this dedicated HR manager can even be on-site at your office. For example, Paychex PEO has dedicated safety representatives that can help your company meet regulations established by OSHA (Occupational Safety and Health Administration).

By working directly with your employees, Paychex takes HR outsourcing to the next level. Since Paychex works so closely with your company, it makes it easier to assess workplace risks and address key areas of liability.

These are some of the top features and benefits of using Paychex as your PEO provider:

- Insurance plans

- Time and attendance

- Payroll administration

- Employee benefit accounts (HSA, FSA, HRA)

- 401(k) plans

- Recruiting

- Workers Compensation

- Risk management

- Unemployment insurance

Like other PEO providers, Paychex also offers individual services if you don’t need a full-service plan. Many of their clients are not PEOs, so they are comfortable sharing the load in a variety of ways.

It is as much, or as little, help as you need. You could use Paychex PEO simply to take payroll and essential HR off your plate–never think about an IRS change ever again. Or you could use them to help set up comprehensive performance management or workplace safety initiative.

The price for Paychex PEO services is based on the number of employees you have. Request a free consultation today to find out the exact cost for your business.

ADP TotalSource

- Full-service PEO solutions

- Web dashboard & mobile app

- 401(k) plans

- Top notch customer service

ADP is an industry leader in human resources software. They provide their services to businesses of all shapes and sizes.

ADP also offers TotalSource, their full-service PEO solution.

This is a great option for small to medium-sized business owners. Whether you have 1-49 employees, 50-999 employees, or 1,000+ members on your team, ADP has a plan for you.

ADP TotalSource is used for human resources, talent management, payroll, employee benefits, and risk assessment.

As a small business owner, you can use ADP to provide enterprise-grade medical, dental, and vision care to your employees. Furthermore, ADP also offers 401(k) plans.

The technology used by ADP is the biggest standout of this PEO provider. Everything from HR to payroll, benefits, and recruiting can be accessed and managed through a mobile app or easy to use web dashboard.

But arguably the best feature of ADP is the customer service.

Naturally, your employees will have questions. Whether it be about their pay, benefits, or something else that would fall into the HR category. Rather than bothering you with those questions, your staff can simply contact an ADP representative directly.

ADP’s knowledgeable and friendly staff will guide your employees in the right direction to answer any questions or help them pick a plan that fits their needs.

I like ADP because they also have industry-specific solutions for businesses in the following categories:

- Restaurant and hospitality

- Manufacturing

- Healthcare

- Construction

- Government and education

- Nonprofit

- Professional and technical services

- Financial services

ADP provides PEO services and technology in over 140 countries worldwide.

The only potential downside of using ADP TotalSource is the company’s size. Since ADP is so large, it’s possible that your small business could feel like it’s getting lost in the shuffle.

Justworks

- Basic and Plus plans

- Easy to scale as you grow

- Wide range of services

- 24/7 customer support

Justworks is a full-service PEO provider offering payroll, human resources, compliance, and employee benefits.

In addition to benefits like health, vision, and dental insurance, Justworks also provides a wide range of compliance services. They handle W-2 and 1099 filings, unemployment insurance, and workers’ compensation.

Justworks has an automated payroll system for direct deposit, paying vendors and contractors, and integration with your business accounting software like Quickbooks and Xero.

Another benefit of Justworks is that they can accommodate the needs for businesses of all sizes. So if you start working with them now, they can scale with you as your company grows.

Here’s an overview of their plans and pricing based company size:

Basic — Payroll, HR Tools, Benefits, and Compliance

- Less than 25 employees — $49 per month per employee

- 25-99 — $44 per month per employee

- 100-174 — $39 per month per employee

- 175+ — Custom pricing

Plus — Access to Medical, Dental, and Vision

- Less than 25 employees — $99 per month per employee

- 25-99 — $89 per month per employee

- 100-174 — $79 per month per employee

- 175+ — Custom pricing

You can save 15% on all plans when you sign up for an annual contract.

I like Justworks because they give you so many options. You’re not forced to take the health insurance package, but it’s available if you want it. If you’re just starting out and new to working with PEO service providers, you could always start with the Basic plan and upgrade to Plus when you’re ready.

Justworks offers 24/7 customer support. The company is modern and still growing at a rapid rate, so I expect them to continue providing excellent service in the future.

The only real downside of Justworks is their lack of experience. There are other PEO service providers who have been in business for decades.

Visit JustWorks to learn more.

VensureHR

- Full-service PEO solutions

- 4 billion+ in annual payroll processing

- 250,000+ employees served

- Great for small businesses!

VensureHR offers a full range of HR solutions that helps simplify your processes.

Their services include:

- Payroll administration

- Benefits solutions

- Risk management

- Workers’ comp

- HR solutions

While their services are robust enough for companies of many different industries and sizes, they’re focused on helping small businesses manage their HR solutions.

That means if you’re a small business owner, you can focus on pulling the levers that boost growth instead.

Many PEO services won’t be willing to work with less than 100 employees, but VensureHR has specific services set up for companies with 1-49 employees.

This means that small businesses can get all the help they need, even if they never plan on massive growth. They’ll still be able to offer comprehensive benefits without having to hire a full-time person in house.

Should your company grow beyond 50 employees, VensureHR has dedicated plans for midsize and large business, so you can grow with them, too.

Pricing is obscured on their website, but you can request a quote at anytime by filling out a form.

TriNet

- In business for over 30 years

- Strong attention to detail

- Niche-specific solutions

- Over 16,000 clients!

If you are a small business that’s not planning on massive growth, TriNet is definitely worth checking out. They offer mutlipe PEO services for business with less than 100 employees, including plans for as few as five.

At first blush, TriNet is farily similar to some of the others in the industry. But they also offer niche-specific solutions for:

- HR consulting

- Benefit options

- Payroll

- Risk mitigation

- Technology

TriNet stands out as one of the best PEO providers because of their service and attention to detail. Their team will be on standby for your employees.

Whether it’s during the hiring process, onboarding, or just day-to-day questions about their benefits or employee status, TriNet is there for all of those needs.

TriNet does not try to appeal to larger organizations. In fact, services are segmented by employee size into these three categories:

- 5-19 employees

- 20-99 employees

- 100+ employees

I’d recommend TriNet to those of you who fall on the lower end of this scale. A company with 500 or 1,000+ employees should look elsewhere.

TriNet offers a wide range of employee health benefit options through insurance companies like United Healthcare, Kaiser Permanente, Aflac, Aetna, and MetLife.

TriNet also has partnerships with big brands to offer small businesses and employees marketplace discounts. Some of those brands include Verizon, AT&T, Hyatt, and Avis.

How to Find the Best PEO Service Providers

There are 957 PEO companies in the USA! Find out which one is the best match for your specific needs. Enter your zip code below to begin.

There is quite a bit of information that must be taken into consideration when you’re evaluating a PEO service provider. Since so many companies seem to offer similar services, choosing the best fit for your business can be a challenge.

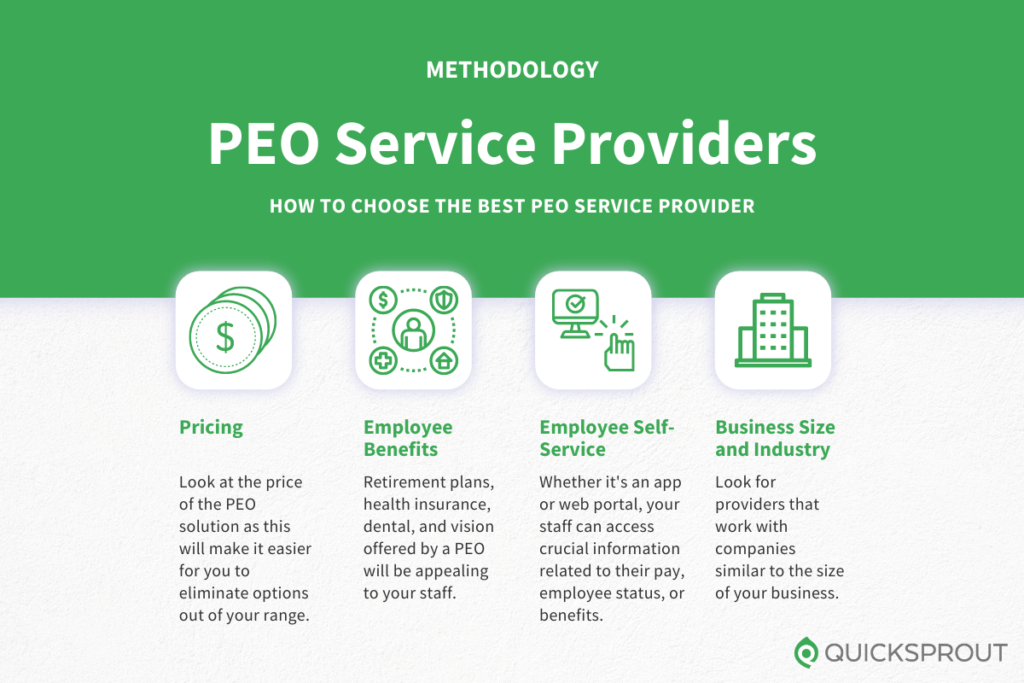

I’ll take you through the methodology that we used to come up with this guide. You can use these features as well during your search process.

Pricing

The first thing you should look at is the price of the PEO solutions. This will make it easier for you to eliminate options that might be out of your price range.

Unfortunately, it’s rare that a PEO provider includes prices on their website. Since so much about this industry is customized, you’ll need to speak with a sales representative to get a quote.

But if you’re looking for a provider with transparent prices, Justworks will be a top option for you to consider. They offer simple PEO pricing up for up to 174 employees–after that point, you’ll have to get in touch for a custom quote.

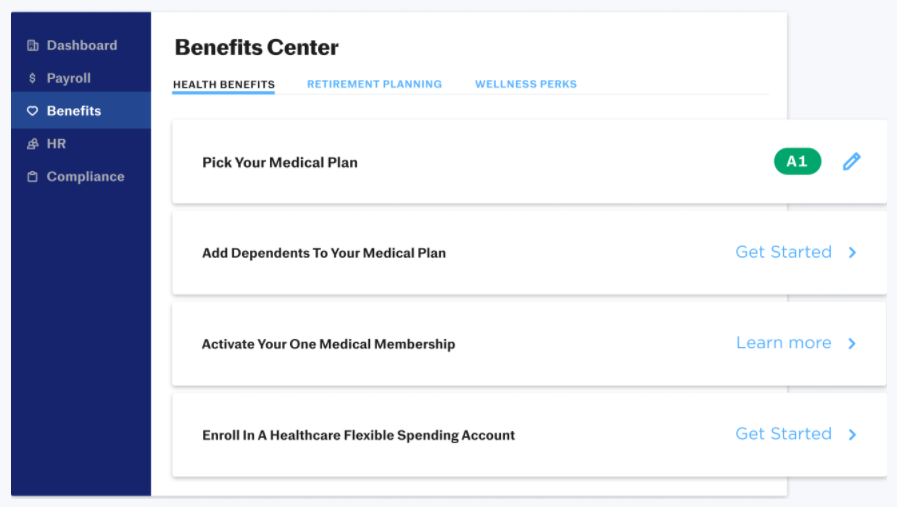

Employee Benefits

While a PEO provider is supposed to reduce costs making your life easier as a business owner, it should also have a positive impact on your employees.

Things like retirement plans, health insurance, dental, and vision offered by a PEO will be appealing to your staff. Not only will this keep your employees happy, but it will also help you hire top-level talent.

Another perk is that all of these benefits are easy to access. Your PEO provider will help you get set up and employees will manage everything through a single dashboard.

No more confusion during open enrollment, just a simple process for people to follow. In Justworks, for example, employees are walked through each step. If they need information or clarification, it’s always a click away.

Some PEO providers work with just one health insurance company, while others provide a wide range of options. So, if diverse plans from varying providers is important to you, then make sure you find a PEO solution that can accommodate those needs.

Employee Self-Service

The best PEO providers offer technology for employee self-service. Whether it’s an app or web portal, your staff can access crucial information related to their pay, employee status, or benefits.

If the self-service options are not sufficient, you want to make sure that your PEO provider will be available to answer any questions via phone, email, or live chat for your employees.

Your staff should be able to do this without having to go directly through you to speak to an outsourced HR representative.

Business Size and Industry

A startup with five employees and a franchise with 2,000 employees across 50 locations will not be in the market for the same PEO service provider. Look for providers that work with companies similar to the size of your business.

Furthermore, some PEO providers specialize in certain industries. Ideally, you want to work with a provider who understands your industry, whenever possible.

There’s only so much research you can do on your own via public resources. I suggest shortlisting your top choices and getting in touch. They can provide references from other companies they work with who match your size and industry. If they can’t, it might be a red flag.

Finding a PEO provider that already knows how to support your organization is the best-case scenario.

The Top PEO Services in Summary

Hiring a PEO service provider can save you time and money if you need some assistance running payroll, managing benefits, and handling HR tasks.

Not every business is looking for the same thing in a PEO solution. Some companies want a full-service PEO package, while others just want an outsourced HR representative. Some PEO services are industry-specific, while others are intended for businesses of a certain size.

from Quick Sprout https://ift.tt/4imXhvE

via IFTTT